Ranks Rocket Now Become Paid

Get Powerful Backlinks We having 20K+ Monthly Traffic with 35+ DA & 30+ PA

We value your privacy

We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies.

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

If you’re considering ways to improve your security, working with a local Security Company North York is a smart choice. In this blog, we’ll explore the top benefits of choosing a local security company and why it matters more than ever.

This blog takes you beyond the guidebooks and into the heart of Galway’s artistic soul. You’ll discover street performances, independent galleries, traditional craft shops, and unforgettable cultural experiences.

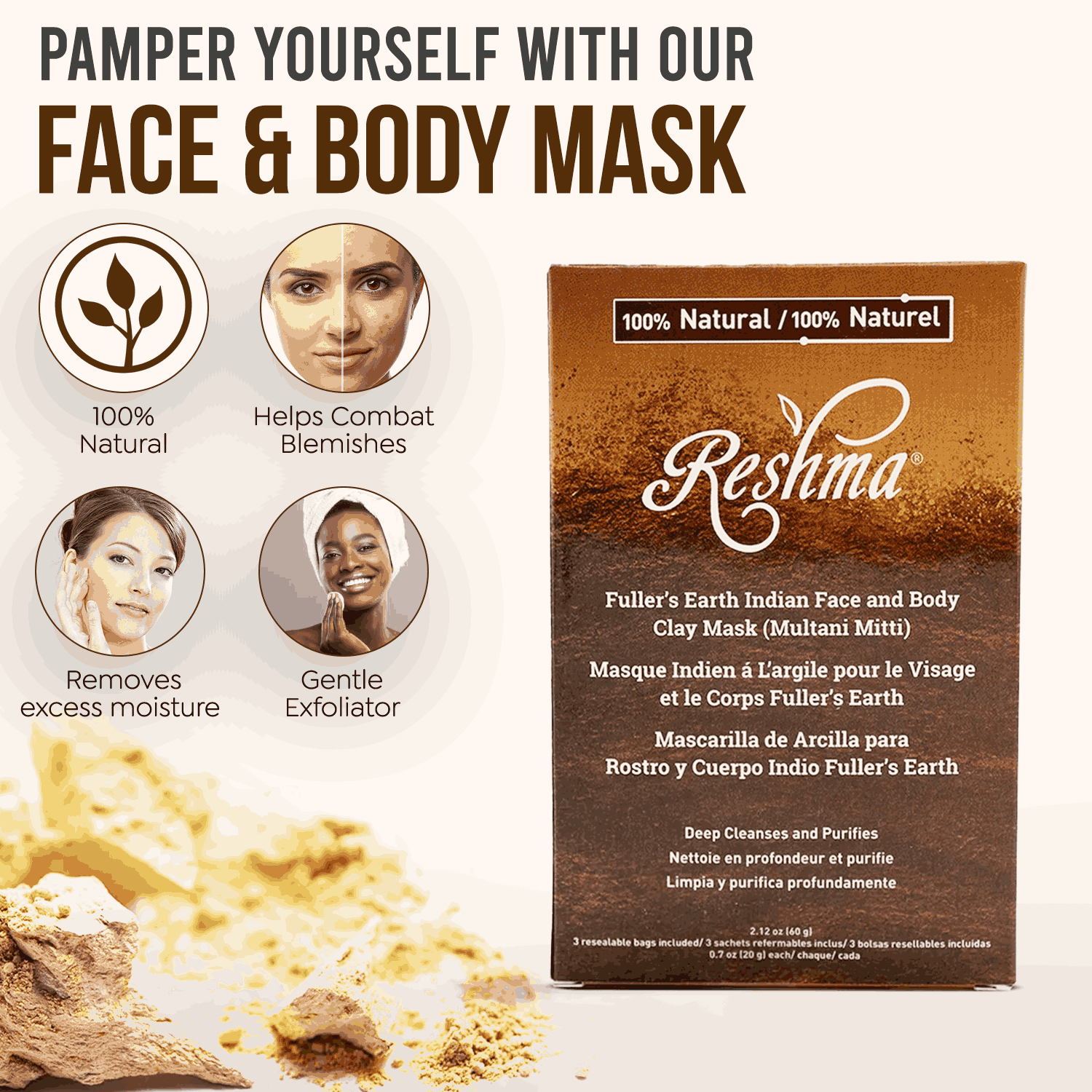

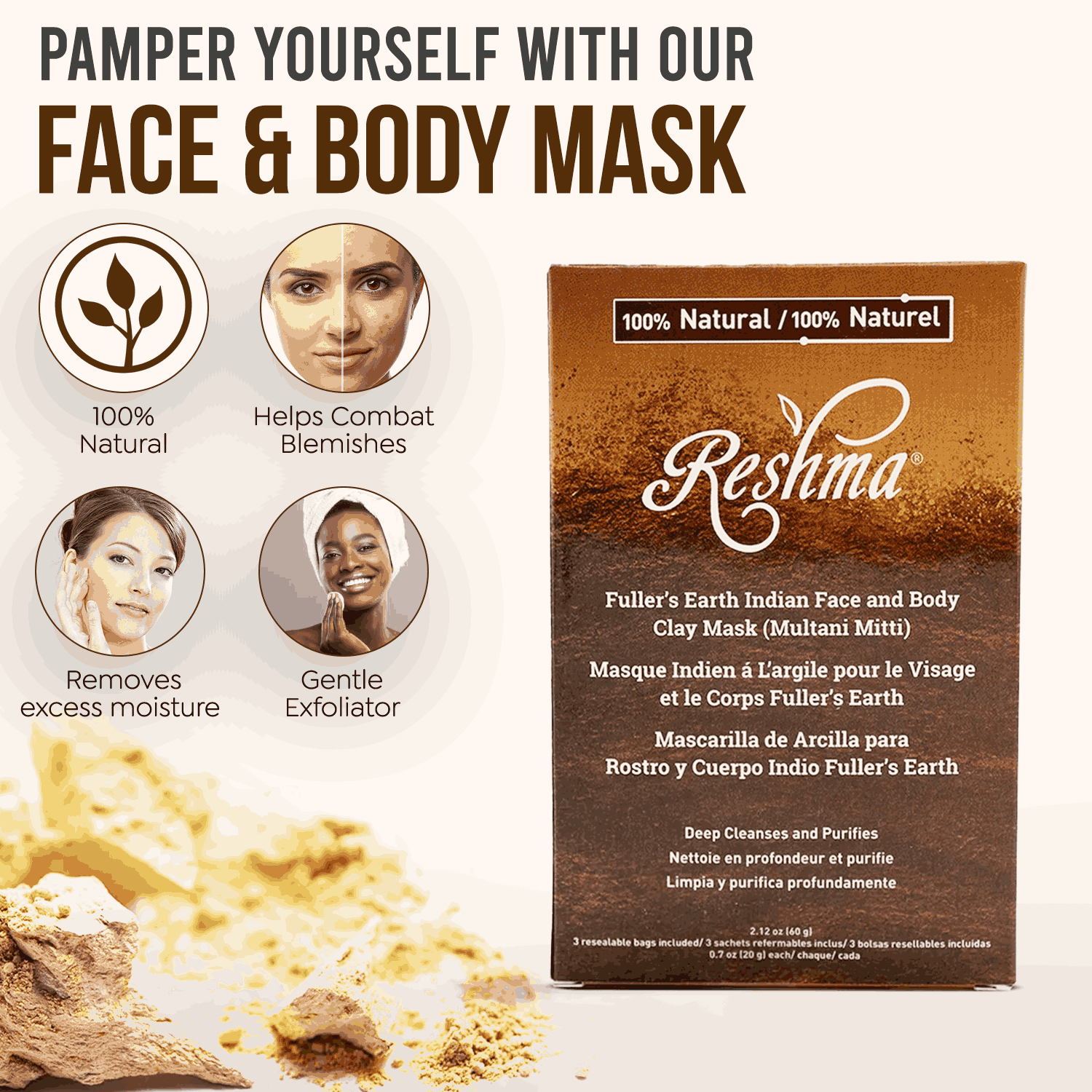

When it comes to natural skincare, clay masks have always held a special place. From deep cleansing to oil control, these masks are known for their ability to rejuvenate the

ฉีดหน้าเรียว เป็นเรื่องง่าย ยาฉีดหน้าใส ปลอดภัย และไม่ต้องรอนาน เหมาะสำหรับผู้ที่ต้องการสวยวันนี้! agent-skin เป็นผู้นำออนไลน์อันดับ 1 ฉีดหน้า.

Telemedicine is reshaping the way we access healthcare, making it more convenient and accessible than ever before. With just a few clicks, patients can connect with doctors from the comfort of their own homes. This shift has been accelerated by technological advancements and changing consumer expectations.

Introduction As software products become more user-centric, quality assurance is expanding beyond functional correctness to include user experience (UX). Even the most technically sound application can fail in the market

See how enhancing university facilities management software with mobile access tools improves efficiency, reduces maintenance delays, and boosts campus safety.

Introduction Enterprise software users and business process owners face an escalating challenge: modern workflows span multiple applications, systems, and platforms. While traditional training focuses on individual software mastery, real-world productivity

Whether you choose a sofa cum bed 6*6, a classic sofa cum double bed, or a folding model with clever storage, the right piece will make your home smarter and more comfortable. Explore various designs, understand the folding sofa bed price range, and pick the one that suits your lifestyle the best.

When was the last time you had a dental checkup? If it's been more than six months, you could be missing out on more than just clean teeth—you could be

Discover how smart web design and software technologies improve SEO to real estate investors. Boost rankings, leads, and conversions with a future-ready website.

Triptych artwork is a form of visual storytelling composed of three separate panels that are unified by a common theme, subject, or aesthetic.

Stuck on the road? Get fast, 24/7 roadside recovery services for flat tires, towing, fuel delivery & more. Trust ResQ for quick help anytime!

Sugar Specialist Doctor in Hyderabad: Your Guide to Expert Diabetes Care

Black-Manga เป็นแอพอ่านการ์ตูนออนไลน์ยอดนิยมที่ครองใจผู้ใช้งานทั่วประเทศไทย ด้วยการรวบรวมมังงะแปลไทยจากหลากหลายประเทศ ไม่ว่าจะเป็นญี่ปุ่น จีน หรือเกาหลี ผู้ใช้งานสามารถเพลิดเพลินกับเรื่องโปรดได้อย่างสะดวกทุกที่ทุกเวลา รองรับทั้งระบบ Android และ iOS โดยไม่เสียค่าใช้จ่ายในการอ่าน นอกจากนี้ยังมีระบบการจัดหมวดหมู่ที่เข้าใจง่าย ค้นหาเรื่องโปรดได้รวดเร็ว พร้อมอัปเดตตอนใหม่อย่างสม่ำเสมอ ทำให้ผู้ใช้งานไม่พลาดทุกความเคลื่อนไหวของเนื้อหาใหม่ล่าสุด

If you’re ready to start the negotiation process and elevate your practice profitability, our team is here to help. Let us show you how the right strategy can transform your bottom line—because your practice’s financial health matters just as much as your patients’ oral health.

In today’s saturated digital landscape, it’s not enough for businesses to “exist” online—they need to thrive. That’s where the top digital marketing agency comes into play, bringing expertise that transcends conventional strategies.

When it comes to planning a special occasion like a wedding, birthday, anniversary, or corporate gathering, one of the most important decisions is selecting the perfect venue.

Explore how AI medical scribes ease documentation, improve care, and address safety, privacy, legal, and integration concerns in clinical practice.

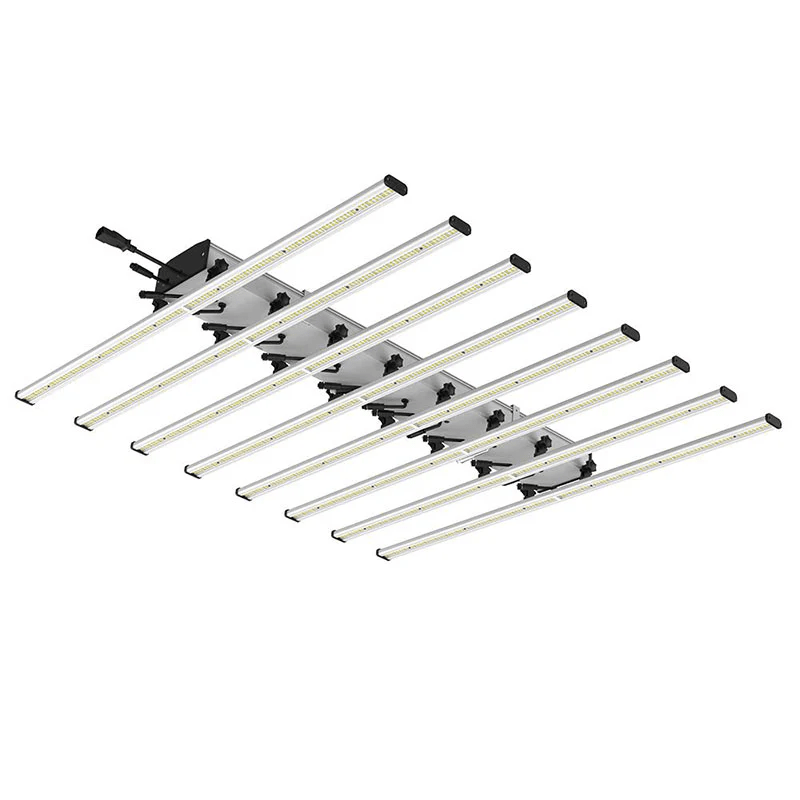

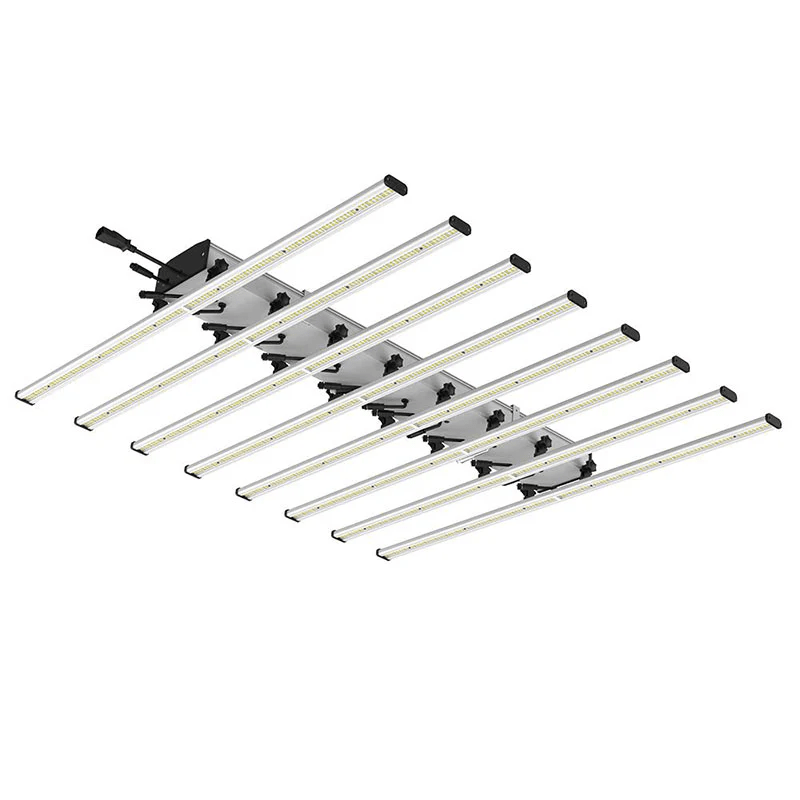

Explore Maverick’s Spider LED Grow Light for cannabis and indoor farms. Maximize yield, reduce energy use, and control every stage of growth with full-spectrum lighting.

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.