Introduction

The payment wallet market has become one of the most significant components of the global financial ecosystem. With the rapid advancement of digital infrastructure, mobile penetration, and e-commerce, payment wallets are transforming how consumers and businesses handle money. These wallets offer a secure, fast, and convenient way to store and transfer funds, eliminating the need for physical cash or cards. Payment wallets are now widely used for online purchases, bill payments, peer-to-peer transfers, and even in-store transactions using QR codes or NFC technology. Their role is critical in driving financial inclusion, especially in developing economies.

Market Size

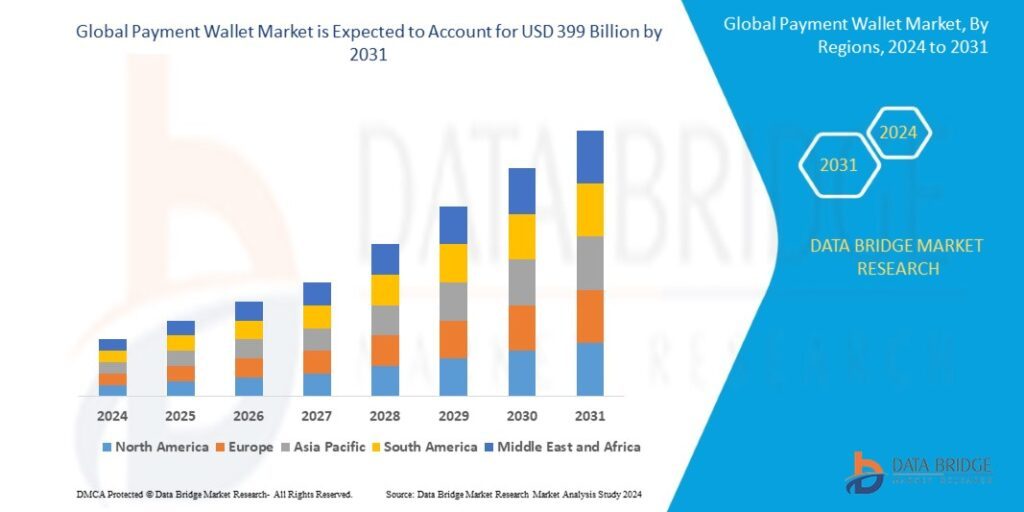

Data Bridge Market Research analyzes that the global payment wallet market size is valued at USD 100.2 billion in 2023 and is predicted to reach USD 399 billion by 2031 by the year 2031 at a 16.8% CAGR during the forecast period for 2024-2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

For More Information Visit https://www.databridgemarketresearch.com/reports/global-payment-wallet-market

Market Opportunities

Several opportunities are fueling the payment wallet market’s expansion. Firstly, the unbanked population in emerging economies represents a massive untapped segment. Payment wallets provide these individuals with access to financial services without the need for a traditional bank account. Secondly, the increasing preference for contactless payments due to health concerns has pushed businesses and consumers toward mobile wallets. Another key opportunity lies in cross-border transactions. As global e-commerce grows, consumers are demanding seamless international payment methods, which digital wallets can facilitate. Integration with loyalty programs, embedded financial services, and AI-based spending analytics are also enhancing user engagement and creating monetization avenues for wallet providers.

Market Share

The payment wallet market is highly competitive, with both global tech giants and regional players vying for market share. Apple Pay, Google Pay, PayPal, and Samsung Pay dominate in North America and parts of Europe. In Asia, local leaders like Alipay, WeChat Pay, and Paytm command significant user bases. Alipay and WeChat Pay together account for more than 80% of China’s mobile wallet market. Paytm holds a similar dominant position in India. In developed markets, traditional banks are also entering the space with their own wallet solutions. The competitive landscape is marked by strategic partnerships, acquisitions, and product innovations aimed at increasing customer loyalty and transaction frequency.

Market Demand

Demand for payment wallets continues to surge as consumers prioritize convenience and speed in their financial transactions. The younger demographic, particularly millennials and Gen Z, show a strong preference for digital-first financial tools. The demand is also being driven by merchants, especially small and medium enterprises, who benefit from lower transaction costs and real-time settlements. Governments in several countries are also promoting digital payments through subsidies, tax incentives, and regulatory support, further amplifying demand. Subscription services, streaming platforms, ride-sharing, and online food delivery are among the key sectors contributing to the growing use of payment wallets.

Market Trends

Several trends are shaping the current and future landscape of the payment wallet market. One of the dominant trends is the shift toward super apps, where wallets are bundled with services like shopping, booking, insurance, and investments. Another trend is the integration of biometric authentication such as facial recognition and fingerprint scanning, enhancing security and user experience. Blockchain and cryptocurrency wallets are gaining traction, offering decentralized alternatives to traditional finance. Buy Now, Pay Later (BNPL) features are being incorporated into wallet platforms to increase transaction volume and customer stickiness. Additionally, voice-enabled transactions and AI-powered financial assistants are beginning to emerge as part of advanced wallet ecosystems.

Market Growth

The growth trajectory of the payment wallet market remains strong across all regions. Developed economies are experiencing moderate but stable growth as wallet adoption becomes mainstream. In contrast, emerging markets in Africa, Latin America, and Southeast Asia are seeing exponential growth due to increasing mobile penetration and digital literacy. Government initiatives such as India’s Digital India campaign, Africa’s mobile money revolution, and Brazil’s Pix system are key catalysts. Payment wallet providers are also expanding into new verticals such as micro-lending, insurance, and wealth management, which is contributing to market growth. Investments in AI, blockchain, and cybersecurity are further driving innovation and scalability.

The payment wallet market is no longer just a fintech innovation—it is a foundational element of the digital economy. As technology evolves and consumer expectations rise, the ecosystem around digital wallets will continue to grow, diversify, and deepen its impact on global commerce.