We value your privacy

We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies.

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

Discover how builders in Hove, Worthing, Shoreham, and Brighton are leading with smart tech, sustainable materials, and modern design innovations.

Discover which Air Jordan 4 colorway holds the highest resale value and why collectors are investing big in these iconic sneakers. A must-read for sneakerheads!

Discover the essential electrical services every Tonbridge homeowner should know, from safety checks to smart home upgrades. Stay safe and future-ready with expert advice.

Need reliable protection? Learn when to hire a security guard Houston, TX and how Houston armed security can safeguard your business, property, or event.

Looking for satellite installation, aerial setup, or data cabling in Kent? Wear Communications delivers expert services for strong, reliable connectivity.

Explore BSA Chapter 1 to understand the scope, definitions, and foundation of India’s new evidence law, 2023.

If you rely on pressure gauges to keep your systems running smoothly, knowing when to replace your Trerice Pressure Gauge is crucial. These instruments help monitor pressure in various industrial

Discover Seoul’s must-visit supermarkets for home supplies. Explore top spots for groceries, decor & essentials all in one trip!

Trumpet vases are the unsung heroes of home decor and event styling, offering a timeless elegance that can elevate any space without breaking the bank. Whether you're planning a wedding,

IVR systems in 2025 have become essential tools for businesses to handle customer calls efficiently. Modern IVR helps automate routine queries, reduce staff workload, and improve response times. This blog explains how companies in sectors like healthcare, education, and ecommerce benefit from IVR, what features to look for in a provider, and how to set up a simple and effective call flow. The right IVR Service Provider can boost customer satisfaction while saving time and money.

Speciality Valve is a trustworthy Water Pressure Reducing Valve Manufacturer in India

Explore tobacco company stocks, tobacco stocks in India, and learn how a stock market technical analysis course can guide your investment choices.

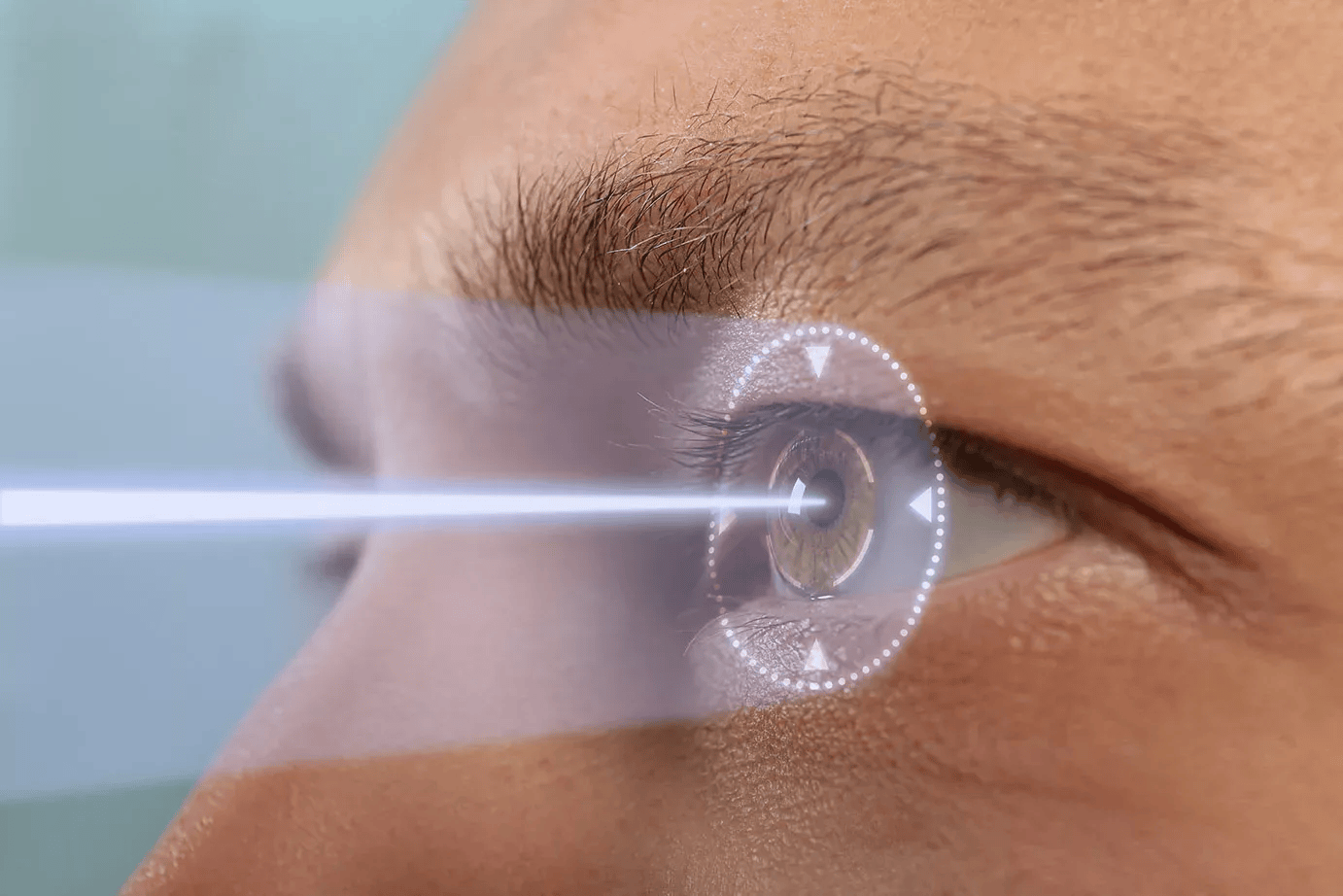

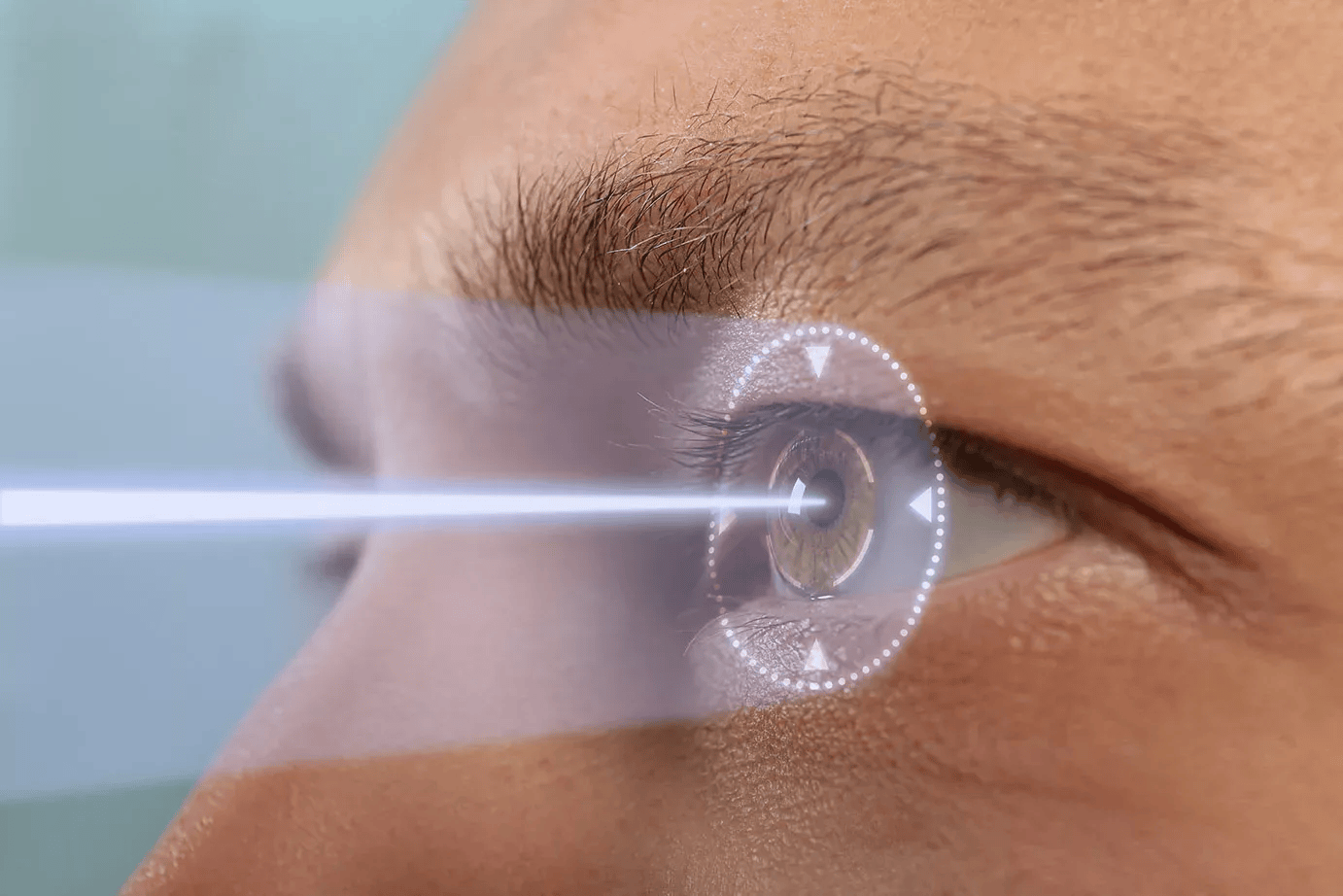

Mitra Eye Hospital in Phagwara is a trusted name for advanced laser eye care and glaucoma treatment. Recognized as the Best LASIK Laser hospital in Phagwara, the hospital offers bladeless, pain LASIK using Wavelight EX500 technology for those suffering from myopia, hyperopia, or astigmatism. It ensures quick recovery, high success rates, and affordability through EMI options.

Ekam Fertility is a top infertility centre in Hyderabad, offering infertility treatments, fallopian tube blockage, endometriosis, and female infertility.

In the relentless rhythm of modern life, our homes have become more than just shelters; they are sanctuaries. Finding pockets of peace and visual tranquillity within these spaces is no

Transform your property with expert insulation services from Penguin Insulation, ensuring comfort, energy efficiency, and long-term savings.

Explore expert lighting installation tips to enhance your home’s style, safety, and energy efficiency with the perfect fixtures for every room.

Wedding photography should beautifully capture every minute of your once-in-a-lifetime day, capturing all the emotions, details, and memories. In Jakarta, couples can experience a realm of creative expression at Korean Artiz Studio, where modern flair meets classic romance. You may bring your vision to life at their studio with their flexible choice of themes, whether it’s a romantic Korean drama-inspired session or a sleek, fashion-forward style. Each frame is an artistic expression of your love story, captured with professional-grade lighting, carefully selected setups, and top-of-the-line equipment.

Access points are a critical part of any wireless network. They connect wireless devices to the wired network, manage traffic, and ensure secure and stable internet access. Understanding the types of access points and how to monitor and manage them will help you create a stronger and more efficient network. Whether you’re supporting a home, office, or large business, choosing the right access point setup is a key step toward reliable connectivity.

Smart, scalable, and secure — build the digital foundation your industry needs with innovative technology solutions that power lasting growth.

Discover how builders in Hove, Worthing, Shoreham, and Brighton are leading with smart tech, sustainable materials, and modern design innovations.

Discover which Air Jordan 4 colorway holds the highest resale value and why collectors are investing big in these iconic sneakers. A must-read for sneakerheads!

Discover the essential electrical services every Tonbridge homeowner should know, from safety checks to smart home upgrades. Stay safe and future-ready with expert advice.

Need reliable protection? Learn when to hire a security guard Houston, TX and how Houston armed security can safeguard your business, property, or event.

Looking for satellite installation, aerial setup, or data cabling in Kent? Wear Communications delivers expert services for strong, reliable connectivity.

Explore BSA Chapter 1 to understand the scope, definitions, and foundation of India’s new evidence law, 2023.

If you rely on pressure gauges to keep your systems running smoothly, knowing when to replace your Trerice Pressure Gauge is crucial. These instruments help monitor pressure in various industrial

Discover Seoul’s must-visit supermarkets for home supplies. Explore top spots for groceries, decor & essentials all in one trip!

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.