We value your privacy

We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies.

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

Nestled high in the serene wilderness of the Kumaon hills, Binsar in Uttarakhand is a hidden gem for nature lovers, peace seekers, and those who crave an offbeat escape from

Discover the best luxury resorts in Bikaner to stay at Narendra Bhawan in Bikaner, Rajasthan—where royal heritage meets modern elegance and comfort.

Arvind Bannerghatta Road Bangalore is not just a residential space; it is a lifestyle choice. The project reflects the philosophy of integrating comfort with functionality. Developed by Arvind SmartSpaces, this residential enclave offers thoughtfully designed homes that cater to modern day families while being surrounded by lush landscapes. Each apartment is built with a focus on space efficiency, natural lighting and ventilation, offering residents a peaceful and healthy living experience.

One of the most common reasons people visit a dermatologist is for acne treatment. Acne can affect individuals of all ages and may cause permanent scarring if left untreated. Dermatologists often assess the severity and type of acne before recommending an appropriate solution.

This blog explains why mechanical engineers prefer Ansys Mechanical for Finite Element Analysis (FEA). It highlights the software’s accuracy, ease of use, and ability to handle complex simulations like structural, thermal, and multiphysics analysis. The post covers its role in different industries, integration with CAD tools, and advantages like faster design validation and reduced testing costs. It also guides readers on licensing, pricing, and how to buy Ansys software in India through trusted resellers like Corengg Technologies.

Lavangadi Vati is a trusted Ayurvedic tablet that can help relieve cough, sore throat, and hoarseness. Its herbal ingredients work naturally and gently, making it a safe option for many people. Whether you’re dealing with a cold or just want to keep your throat healthy, Lavangadi Vati can be a helpful remedy to keep at home.

If you’re searching for a trusted gynecomastia doctor in Delhi, Dr. Shobhit Gupta at Shobhit Aesthetics is here to help. With advanced techniques, compassionate care, and personalized treatment,

Singapore is home to some of the most prestigious universities and educational institutions in Asia. With a rigorous academic environment and a strong emphasis on performance, students in Singapore often

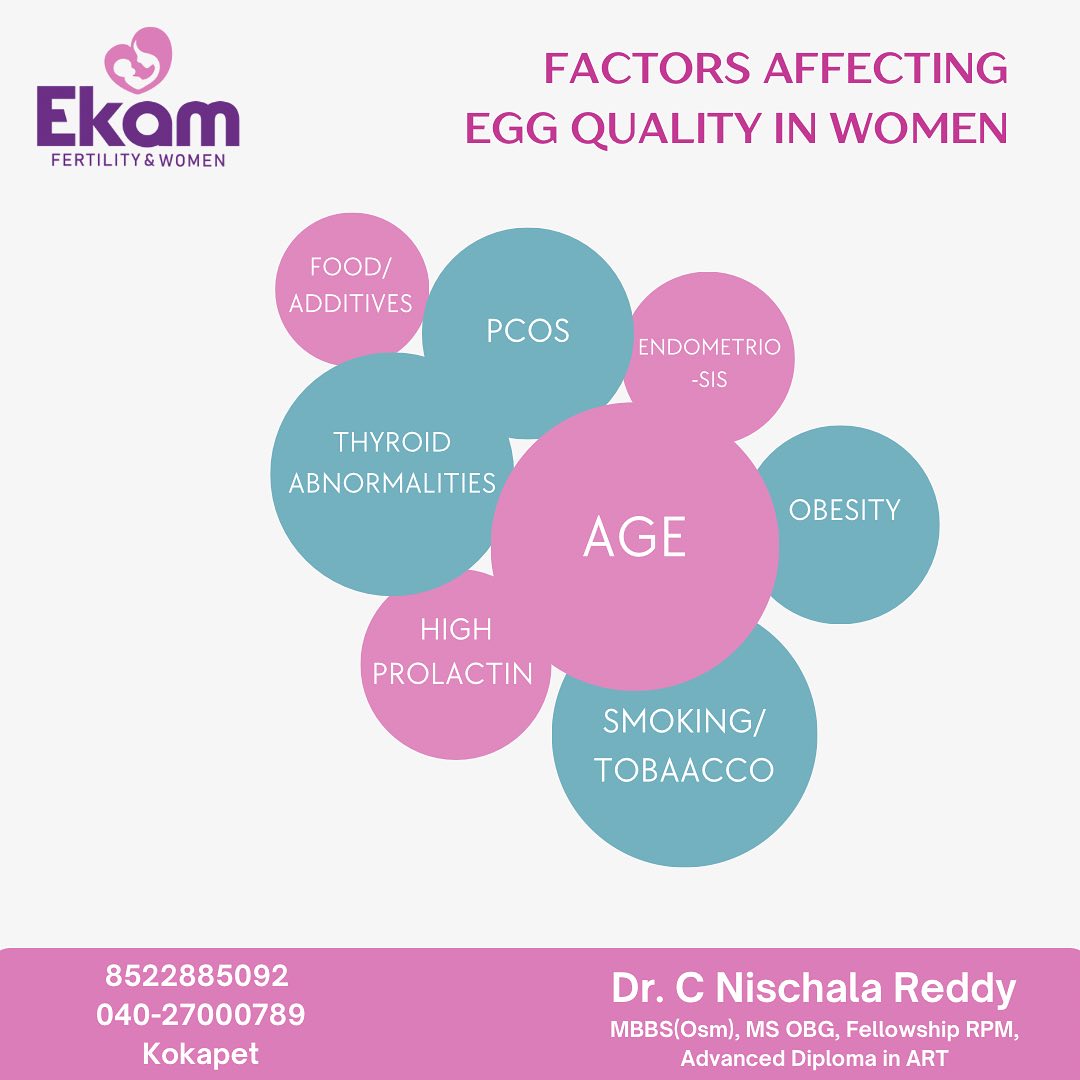

Donor sperm: donors are screened for viral infections & only when negative, their sperm are frozen & used after a quarantine period of 6 months. After 6 months, donors are screened again & only if everything is normal, their frozen sperms are used for other couples.

Increase traffic to your WordPress website by leveraging Search Engine Optimization (SEO). TechHouse uses proven strategies and best practices to optimize your content, enhance your online presence, and attract valuable organic traffic to your website.

In today’s fast-paced digital era, having a strong online presence is no longer optional—it's essential. Businesses of all sizes are turning to the internet to reach their audience, increase visibility,

Our stanchions and crowd control solutions in Canada are made to precisely and professionally handle any situation, whether you’re in charge of an event, a line, or public safety. We take pride in being a top supplier of crowd control goods, providing a large selection of stanchions that meet both functional needs and aesthetic tastes. We have a solution specifically designed for you, regardless of your budget or preference for high-end options with a sophisticated, upscale appearance. From retail and hospitality to major public gatherings, our stanchions in Toronto are designed to accommodate a variety of businesses.

AutoService AI answers all your customers’ calls in one ring. No more hold time. Your team can now focus on business development, your CSI is higher, and your costs are reduced.

AV Solutions Integrated delivers comprehensive staging solutions in Malaysia for conferences, exhibitions, and live events. From AV integration to dynamic lighting and hybrid setups, we create impactful, engaging event experiences.

More than 30% of small businesses in Florida experience some form of criminal activity each year. In busy cities like Miami, the risk can be even higher due to increased

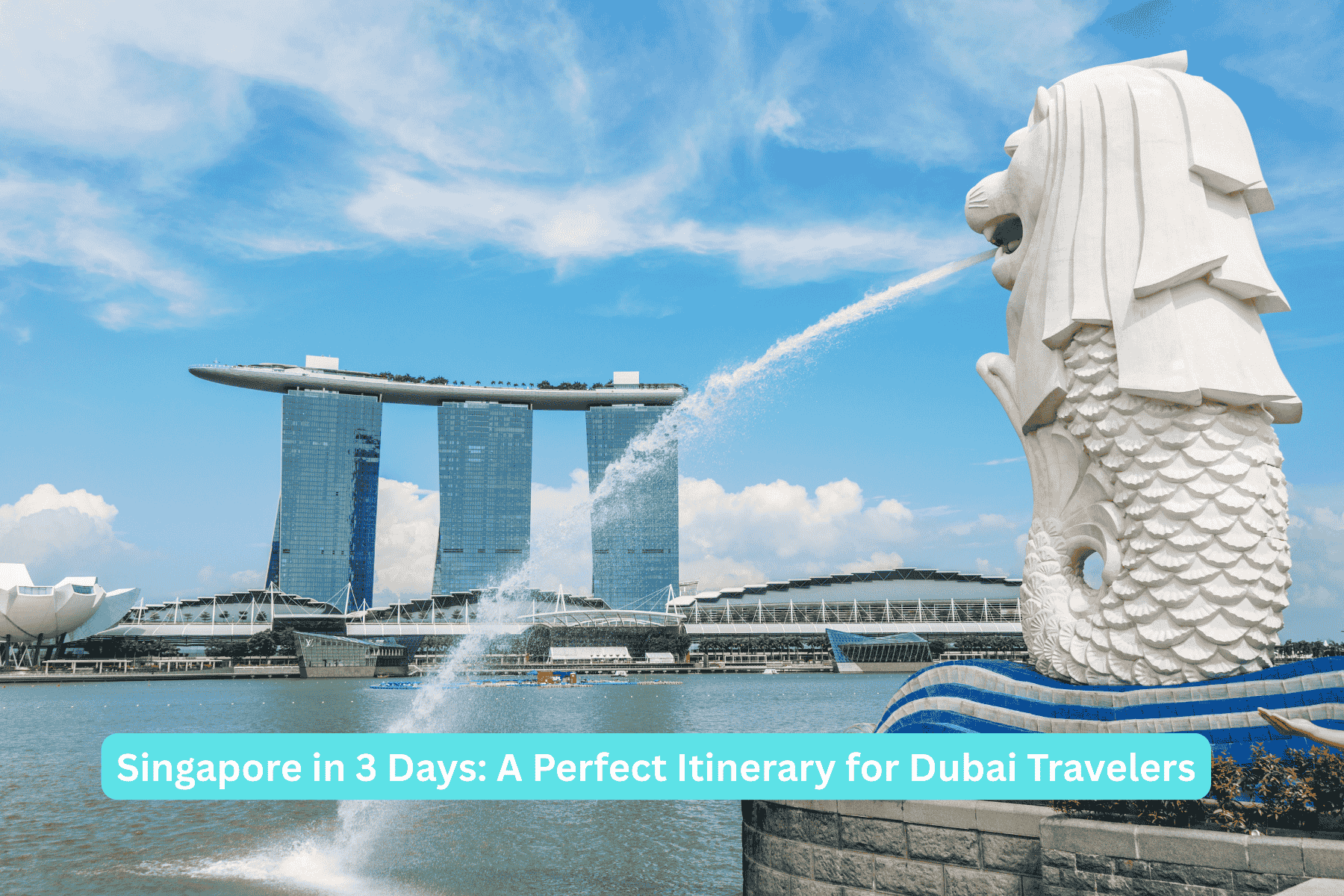

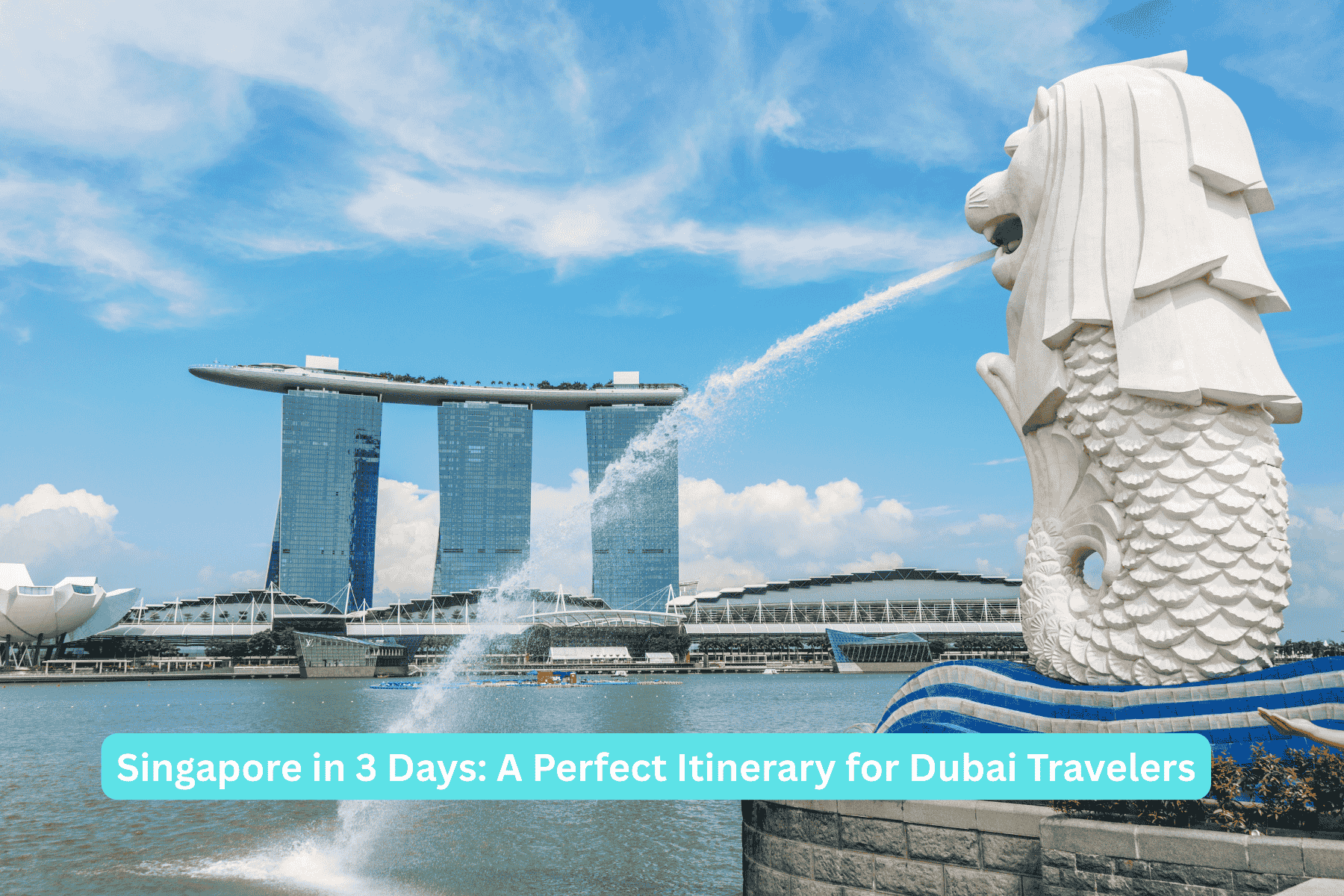

Planning your dream getaway? Getting a Singapore Visa from Dubai is a simple process, allowing UAE residents to explore this magnificent destination hassle-less. Whether you’re traveling for leisure, business, or a quick weekend escape, securing your visa in advance ensures a smooth journey.

AI-powered grid trading bots are transforming how traders operate in the crypto market. These bots place buy and sell orders automatically within predefined price ranges enabling traders to fully capitalize on frequent market fluctuations and increase their trading opportunities.

A T-type strainer is a mechanical filtration device used in pipelines to remove solid particles from liquids or gases. Named for its "T" shape, it consists of a horizontal pipe

Explore a wide range of courses in Media and Entertainment designed to nurture creativity and technical skills. From skill programs in media and entertainment to short-term courses, these options are perfect for aspiring professionals seeking hands-on experience.

Regular soil simply doesn’t match the elemental subtleties blueberries require. In containers, this mismatch is exaggerated, and the results are often disappointing—slow growth, pale leaves, poor fruiting, or even plant death.

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.