The first flop deal I had ever watched was in KYC review, and that took 23 days. Twenty-three days of a sales rep calling compliance. The 23 days of a prospect slowly cooling off. By day 24, the CFO had moved on to a competitor.

I clearly remember that it was 2008, and the faxed documents, notarized signatures, and a compliance officer were involved in this process. It felt like closing a mortgage, not onboarding a software customer.

Today? The best teams complete the same verification in under 48 hours. It’s not simply the technology that makes a difference. It’s a complete rethinking of what KYC means for making money.

How KYC Evolution Impacts Sales Leads Today: The Direct Answer

Modern KYC has transformed from a post-sale bottleneck into a pre-qualification advantage that filters and accelerates sales leads simultaneously. Companies using current kyc compliance software report 60-70% faster onboarding times and 25-40% lower abandonment rates compared to manual processes, directly increasing closed revenue per quarter.

That transformation didn’t happen overnight. Understanding the journey helps sales leaders make better decisions about where to invest next.

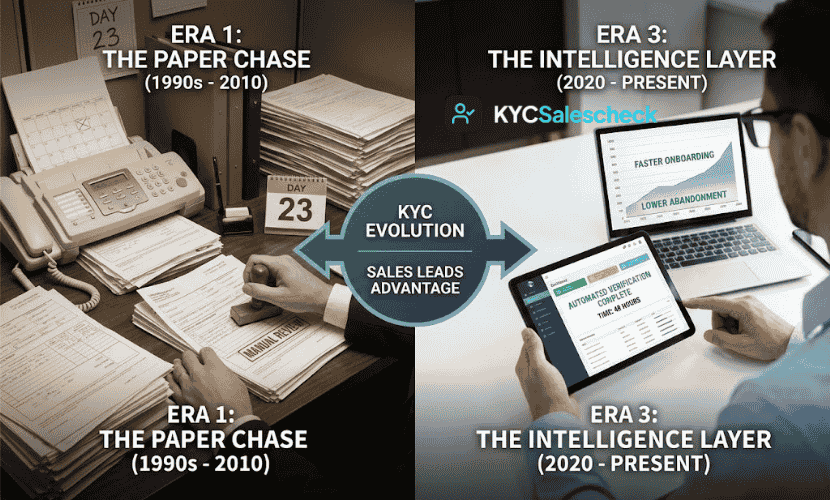

The Three Eras of KYC Compliance

The evolution breaks down into distinct phases. Each one changed how sales teams interact with prospects and how quickly revenue becomes real.

Era 1: The Paper Chase (1990s – 2010)

KYC existed primarily in banking. For most B2B sales organizations, it wasn’t even on the radar. When it was required, the process was brutally manual.

Prospects filled out forms. Sometimes by hand. They sent copies of business licenses, articles of incorporation, and bank statements by mail or fax. A compliance person reviewed everything physically.

Average time to clear compliance: 15-30 days. Sales cycles that should have taken 60 days stretched to 90. Reps compensated by working more deals simultaneously, which meant shallower relationships across the board.

The real killer? No one could give prospects a straight answer about timeline. “It takes as long as it takes” became the standard line.

Era 2: The Digital Translation (2010 – 2020)

Email replaced faxes. PDFs replaced paper. But the fundamental process stayed the same: collect, review, approve.

Early kyc compliance solutions emerged, mostly focused on document management. You could upload files instead of mailing them. Compliance teams could access a digital queue instead of a filing cabinet.

This was progress, but it was translation, not transformation. You’d digitized a broken process. The review was still manual. The timeline was still unpredictable.

Average time to clear compliance: 8-15 days. Better, but still enough time for prospects to reconsider, get cold feet, or find alternatives.

Era 3: The Intelligence Layer (2020 – Present)

Everything changed when verification became automated. API connections to government databases. Machine learning models that spot inconsistencies. Real-time risk scoring.

Modern kyc compliance software doesn’t just manage documents. It makes decisions. Or at least, it makes the easy decisions automatically and routes the complex cases to humans with full context.

Average time to clear compliance: 24-48 hours for standard cases. Some companies are pushing toward same-day verification for low-risk customers.

This isn’t an improvement that happens over time. This is a different kind of skill. And it fundamentally changes what sales teams can promise prospects.

What Changed and Why It Matters to Revenue

The technical improvements are interesting. The business impact is what gets budget approved.

Speed Became a Competitive Differentiator

In 2008, if you told a prospect “compliance review takes two weeks,” they shrugged. Everyone’s process took two weeks. There was no alternative.

In 2026, if you tell a prospect the same thing, they’re evaluating your competitor while you’re still asking for documents. Speed isn’t a nice-to-have. It’s table stakes.

Sales teams using modern lead qualification tools integrated with kyc compliance solutions can now say: “Sign today, you’re live by Friday.” That’s a closing tool. That changes deal dynamics in the final mile.

Data Quality Replaced Document Theater

Old KYC was about collecting proof. New KYC is about verifying truth.

A scanned business license proves someone has a scanner. An API check against the Secretary of State database proves the business is registered, active, and matches the stated ownership structure.

This matters for sales lead qualification because it eliminates a whole category of bad prospects early. The shell companies. The credit risks hiding behind legitimate-looking paperwork. The fraudsters who know how to fake documents but can’t fake a database query.

Your sales team stops wasting time on leads that were never going to convert into healthy customers.

Compliance Became a Sales Asset

Here’s the shift that matters most: Top-performing teams now talk about their KYC process during the sales cycle, not after it.

They position it as diligence. As platform integrity. As evidence that they’re a serious company doing serious business. Prospects don’t object. They appreciate it.

I’ve watched sales calls where the rep says, “Part of our onboarding includes identity verification it’s how we keep the platform secure for all our customers.” The prospect nods. Sometimes they ask questions about the process. No one has ever said “that’s a dealbreaker.”

When your kyc compliance software is fast and professional, it becomes a trust signal instead of an apology.

The Technology Stack That Powers Modern KYC

Sales leaders don’t need to become compliance experts. But understanding the basic architecture helps you evaluate vendors and spot capability gaps.

The Four Core Components

Identity Verification APIs

These connect to government databases, credit bureaus, and commercial registries. They verify that John Smith is who he says he is, that Acme Corp is a real registered entity, and that John actually works there.

Document Intelligence

OCR and machine learning extract data from uploaded documents and flag inconsistencies. If someone’s driver’s license says “New York” but their IP address and bank statements say “Lagos,” the system catches it.

Risk Scoring Engines

These aggregate signals from multiple sources and assign risk levels. Low-risk prospects get auto-approved. Medium-risk goes to enhanced review. High-risk gets declined or escalated.

Workflow Automation

This connects everything to your CRM and sales tools. When a prospect signs a contract, KYC kicks off automatically. When verification completes, your billing system activates. No manual handoffs.

Integration with Lead Qualification Tools

The magic happens when your kyc compliance solutions talk directly to your lead qualification tools. Not through exports and imports. Through real-time data exchange.

When a prospect enters your pipeline, basic verification starts immediately. By the time your rep has the first discovery call, you already know if they’re legitimate. That context changes how you qualify and prioritize sales leads.

Some teams are taking this further: they’re using KYC data to score lead quality. A prospect with clean corporate structure, stable financials, and no red flags? That’s a higher-value lead than one where basic verification takes three tries.

Real-World Impact: The Numbers Sales Leaders Trust

A mid-market SaaS company I advised last year was losing 38% of signed deals in the KYC phase. Their process took 12 days on average. Prospects would sign, then disappear.

They implemented modern kyc compliance software specifically KYCSalescheck, which integrates cleanly with Salesforce and HubSpot. The results in 90 days:

- Average verification time: 2.1 days

- Abandonment rate: 14%

- Net impact: 24 additional closed deals per quarter

- Revenue recovery: $1.8M annually

The CFO approved the investment in week two after seeing the pipeline velocity increase. This wasn’t a compliance project anymore. It was a revenue optimization project.

What Sales Teams Should Demand from Modern Solutions

Not all kyc compliance solutions are built for speed. Some are built for maximum risk mitigation at any cost. That’s fine for banks. It’s death for B2B sales.

Non-Negotiable Capabilities for Sales-First KYC

Tiered Verification Levels

Your $500K enterprise customer and your $5K starter customer shouldn’t go through identical processes. Smart systems adjust depth based on risk and value.

Real-Time Status Visibility

Sales reps need to see exactly where each prospect is in verification. “Compliance is working on it” isn’t good enough. “Document review, estimated completion tomorrow at 2 PM” is what professionals need.

Mobile-Optimized Experience

Decision-makers verify their identity from phones. If your KYC process requires scanning documents on a desktop, you’re adding friction that kills deals.

Proactive Communication

The system should notify prospects about next steps without your team having to chase. Automated emails with clear instructions and progress bars keep people engaged.

Red Flags That Signal Outdated Technology

Watch for vendors who talk primarily about compliance requirements and regulatory frameworks. That’s important, but it’s table stakes.

You need vendors who talk about conversion rates, time-to-revenue, and customer experience. The compliance part should be invisible to prospects. The speed should be remarkable.

The 2026 Reality for B2B Sales Teams

Every sales organization will eventually implement modern kyc compliance software The question is whether you will do it on purpose or by accident.

The proactive companies are using verification as a competitive advantage right now. They’re closing faster. They’re losing fewer signed deals. They’re positioning their process as a feature.

The reactive companies are still explaining to prospects why verification takes two weeks. They’re losing deals to faster competitors. They’re watching their sales reps get frustrated with a process that feels like quicksand.

Making the Shift: Where to Start

If you’re running manual or semi-manual KYC today, the path forward is clearer than you think.

Step 1: Measure What You’re Losing

Track how many signed deals fail to complete onboarding. Track how long verification takes. Calculate the revenue impact. You need this baseline to justify investment.

Step 2: Define Your Requirements

What does success look like? For most B2B teams, it’s verification in under 72 hours with less than 20% abandonment. Be specific about integration needs with your existing lead qualification tools.

Step 3: Pilot with a Modern Solution

Run 20% of new deals through a platform like KYCSalescheck for 60 days. Compare metrics against your baseline. The data will make the decision obvious.

Step 4: Train Your Team to Sell the Process

Once you have fast verification, teach your sales reps to position it as a strength. Practice the language. Make it part of your competitive story.

The Bottom Line

KYC evolved from a necessary evil into a strategic advantage. That shift happened because companies stopped accepting “that’s just how compliance works” as an answer.

The sales teams winning in 2026 treat verification like they treat every other part of the customer journey: as an opportunity to deliver an exceptional experience that reinforces buying decisions.

Your prospects want to buy. Your compliance process should help them do it faster, not slower. The technology exists. The ROI is proven. The only thing you need to think about is how much money you’re willing to lose while you wait to upgrade.