We value your privacy

We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies.

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

Ekam Fertility is a top infertility centre in Hyderabad, offering infertility treatments, fallopian tube blockage, endometriosis, and female infertility.

In the relentless rhythm of modern life, our homes have become more than just shelters; they are sanctuaries. Finding pockets of peace and visual tranquillity within these spaces is no

Transform your property with expert insulation services from Penguin Insulation, ensuring comfort, energy efficiency, and long-term savings.

Explore expert lighting installation tips to enhance your home’s style, safety, and energy efficiency with the perfect fixtures for every room.

Secure, Fast, and User-Centric Software Development Practices. Introduction In today’s tech-driven landscape, software powers everything from business operations to customer experiences. Software developers are the architects of these digital solutions,

Escape stress and restore balance with a 7-day wellness retreat at Palm Beach Wellness Center—featuring yoga, nutrition, mindfulness, and holistic healing.

In today’s competitive entertainment world, high-quality visual storytelling is essential. Whether you're producing a feature film, a web series, or a high-impact commercial, VFX Production Services can significantly elevate the

Discover how an HR consultant can help your business save time, reduce costs, and alleviate stress by streamlining HR processes and ensuring compliance

Explore S-VYASA University Bangalore, a leading yoga and science-based institution. Learn about courses, admission process, facilities, placements, and more.

In emergencies, every second matters. Learn how document management software and a responsive document management system help facility teams access critical information fast, respond with confidence, and maintain continuity—especially with tools like ARC Facilities that put emergency data in your pocket.

Think a small cavity can wait? Here are 7 regrets people have after ignoring their dentist’s filling advice—don’t let it happen to you.

Looking for satellite installation, aerial setup, or data cabling in Kent? Wear Communications delivers expert services for strong, reliable connectivity.

Explore BSA Chapter 1 to understand the scope, definitions, and foundation of India’s new evidence law, 2023.

If you rely on pressure gauges to keep your systems running smoothly, knowing when to replace your Trerice Pressure Gauge is crucial. These instruments help monitor pressure in various industrial

Discover Seoul’s must-visit supermarkets for home supplies. Explore top spots for groceries, decor & essentials all in one trip!

Trumpet vases are the unsung heroes of home decor and event styling, offering a timeless elegance that can elevate any space without breaking the bank. Whether you're planning a wedding,

IVR systems in 2025 have become essential tools for businesses to handle customer calls efficiently. Modern IVR helps automate routine queries, reduce staff workload, and improve response times. This blog explains how companies in sectors like healthcare, education, and ecommerce benefit from IVR, what features to look for in a provider, and how to set up a simple and effective call flow. The right IVR Service Provider can boost customer satisfaction while saving time and money.

Speciality Valve is a trustworthy Water Pressure Reducing Valve Manufacturer in India

Explore tobacco company stocks, tobacco stocks in India, and learn how a stock market technical analysis course can guide your investment choices.

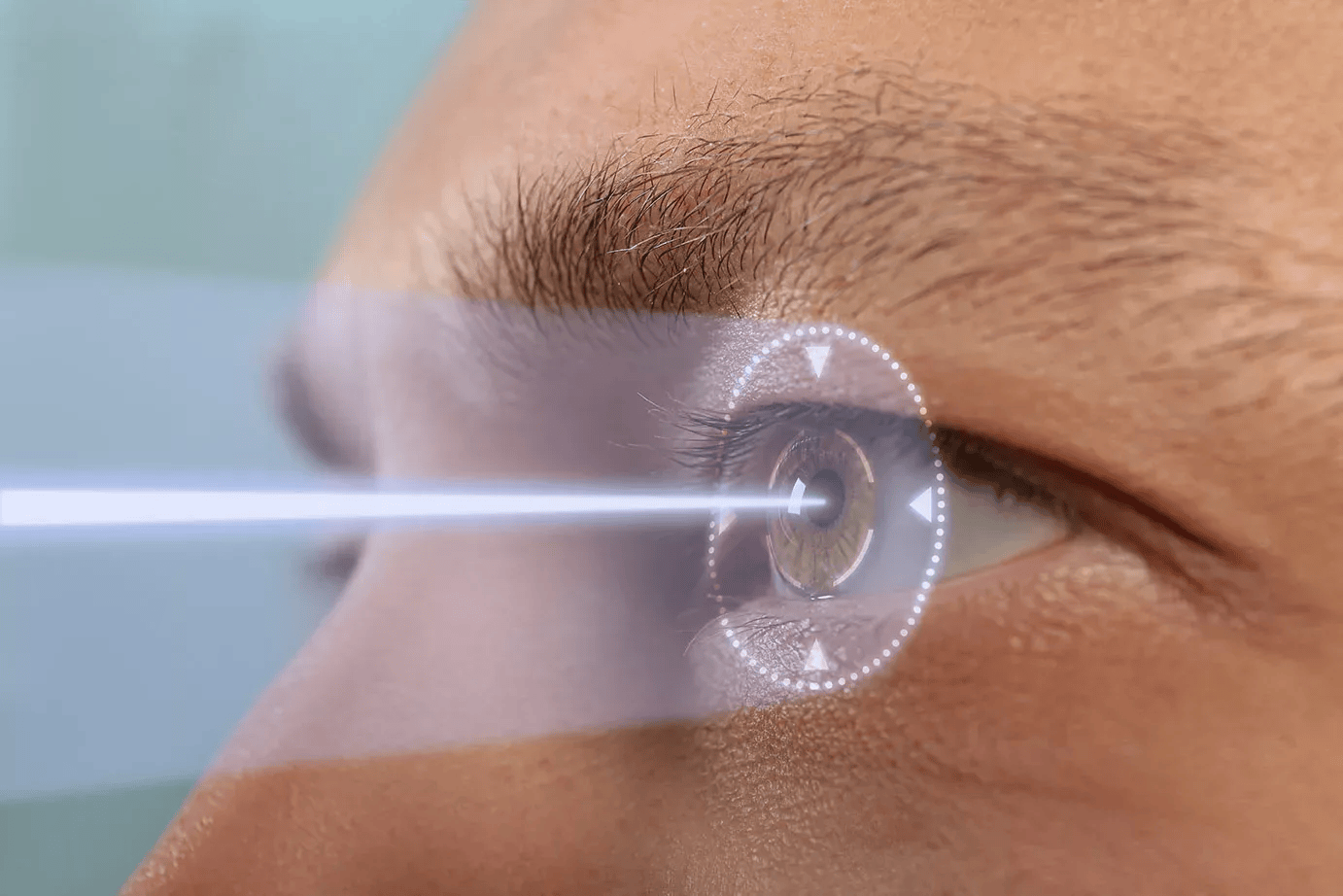

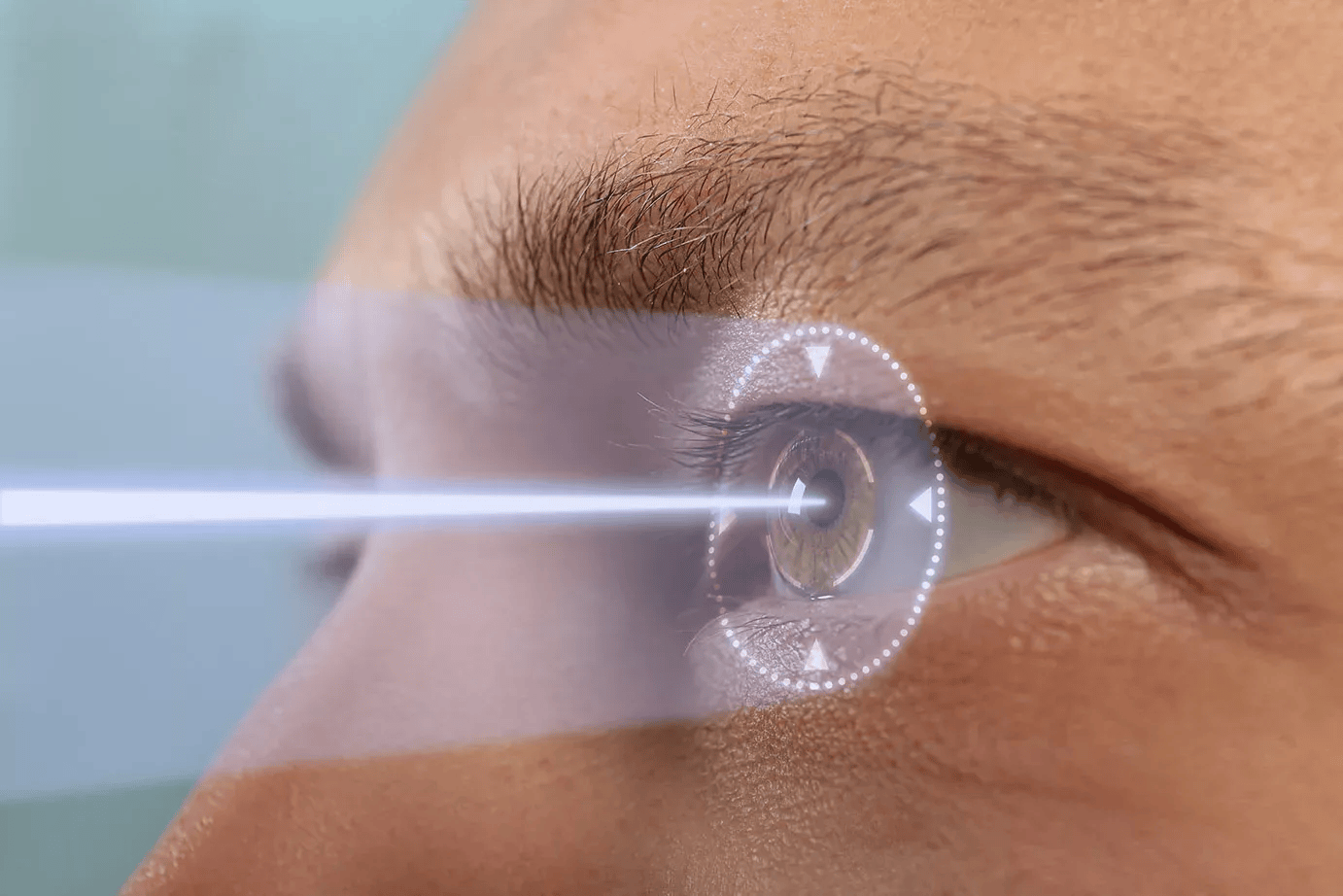

Mitra Eye Hospital in Phagwara is a trusted name for advanced laser eye care and glaucoma treatment. Recognized as the Best LASIK Laser hospital in Phagwara, the hospital offers bladeless, pain LASIK using Wavelight EX500 technology for those suffering from myopia, hyperopia, or astigmatism. It ensures quick recovery, high success rates, and affordability through EMI options.

Ekam Fertility is a top infertility centre in Hyderabad, offering infertility treatments, fallopian tube blockage, endometriosis, and female infertility.

In the relentless rhythm of modern life, our homes have become more than just shelters; they are sanctuaries. Finding pockets of peace and visual tranquillity within these spaces is no

Transform your property with expert insulation services from Penguin Insulation, ensuring comfort, energy efficiency, and long-term savings.

Explore expert lighting installation tips to enhance your home’s style, safety, and energy efficiency with the perfect fixtures for every room.

Secure, Fast, and User-Centric Software Development Practices. Introduction In today’s tech-driven landscape, software powers everything from business operations to customer experiences. Software developers are the architects of these digital solutions,

Escape stress and restore balance with a 7-day wellness retreat at Palm Beach Wellness Center—featuring yoga, nutrition, mindfulness, and holistic healing.

In today’s competitive entertainment world, high-quality visual storytelling is essential. Whether you're producing a feature film, a web series, or a high-impact commercial, VFX Production Services can significantly elevate the

Discover how an HR consultant can help your business save time, reduce costs, and alleviate stress by streamlining HR processes and ensuring compliance

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.