Ranks Rocket Now Become Paid

Get Powerful Backlinks We having 20K+ Monthly Traffic with 35+ DA & 30+ PA

We value your privacy

We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies.

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

selling gold in Australia can be easy if you follow the right steps. Start by identifying your gold items—jewelry, coins, bars, or scrap—and check their purity using hallmarks (like 24K or 18K). Weigh your gold and use online resources like ABC Bullion to find the current spot price.

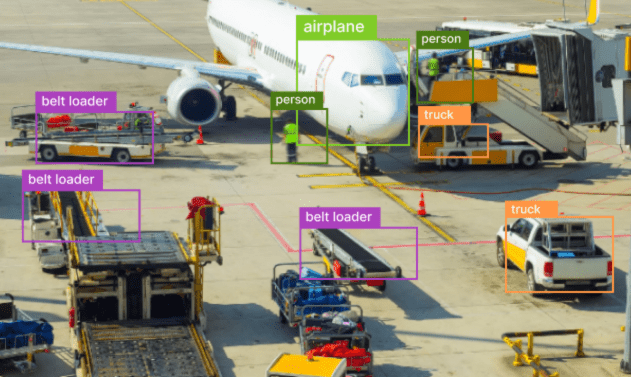

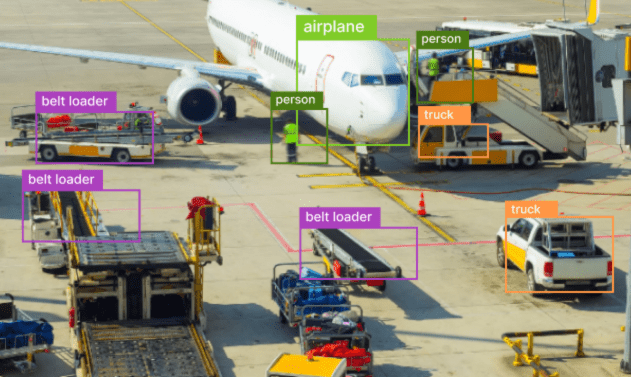

The aviation industry is considered a relevant sector that effectively relies on precision, accuracy and safety. Technological advancements are becoming increasingly popular among various sectors contributing to overall operational efficiency

In a world where space and convenience and and comfort are becoming more vital in choosing a home and Prestige Magadi Road stands out as a perfect destination for families looking for their ideal living space in Bangalore. With a focus on creating spacious and well designed apartments that cater to the needs of modern families and this project by the renowned Prestige Group offers everything one could wish for – from excellent connectivity to premium amenities and making it the ideal choice for those who want to experience luxury and comfort in a serene environment.

The Meditating Hanuman Ji Pendant is a small yet meaningful piece of jewelry that shows Lord Hanuman sitting calmly in meditation. It’s more than just an ornament—it’s a symbol of peace, strength, and protection. Hanuman Ji, known from the Ramayana, teaches us bravery, devotion, and inner calm. Made from silver or gold, this pendant is crafted with care, showing fine details like Hanuman Ji’s tail and peaceful face. People of all ages wear it daily to feel safe, focused, and connected to divine energy. It’s light, strong, and easy to wear during school, work, or play. The pendant also makes a special gift for birthdays and festivals. Many believe it brings good luck and courage in tough times. Whether bought from a temple shop or online, it stays shiny with a little care. The Meditating Hanuman Ji Pendant is a timeless reminder to stay strong, kind, and calm—just like Hanuman Ji.

Spices make food taste better. They bring flavors, colors, and health to your meals. People around the world use spices every day. If you are looking for good quality spices

Basketcase Official | BasketCase Gallery Clothing | New StockBasketcase Official | BasketCase Gallery Clothing | New StockBasketcase OBasketcase Official | BasketCase Gallery Clothing | New StockBasketcase Official | BasketCase Gallery Clothing | New StockBasketcase Official | BasketCase Gallery Clothing | New Stockfficial | BaskeBasketcase Official | BasketCase Gallery Clothing | New StocktCase Gallery Clothing | New Stock

Polymarket clone is a ready-made and 100% customizable script that helps to launch your own prediction market platform effortlessly

Traditional Japanese art and style are deeply rooted in centuries of history, culture, and spirituality.

Roller shutter doors are a practical and robust solution for residential, commercial, and industrial properties. Known for their durability, security features, and ease of use, these doors are increasingly popular in urban areas such as Roller shutter doors Stockton-on-Tees. Whether you need to protect a storefront, warehouse, or garage, roller shutter doors offer unmatched performance and peace of mind.

1-800 WATER DAMAGE of South Central New Jersey offers professional water damage restoration, mold removal, fire damage restoration, and sewage cleanup.

Trapstar, a brand synonymous with urban streetwear, has gradually solidified its position as a cultural icon. Among its array of stylish offerings, one product has stood out and

Introduction: Your Immigration Adventure Begins Hey there! Are you searching for the best immigration solicitors to guide you to the UK? Let us tell you, moving to a new country

Buy Now The Latest Always Do What You Should Do Clothing For Always Do What You Should Do Merchandise Fans With Huge Discount UPTO 40 OFF

Hold Your Good News is a growing platform sharing stories, support, and insights for those navigating fertility journeys in Africa. Our mission is to provide compassionate content that holds space for hope, healing, and honest conversations around motherhood and reproductive health. Connect with us: www.holdyourgoodnews.com

Unlike traditional stanchions, wall-mounted barriers eliminate floor clutter while maintaining a strong visual guide for restricted or managed areas.

Anabole Steroide kaufen – Was Sie über Wirkung, Risiken und Legalität wissen sollten

Welcome to our product review website, your go-to source for honest, informative, and unbiased reviews of the latest gizmos and gadgets available online. In a world where technology is continuously improving, it can be difficult to determine which products genuinely provide value for money.

While the procedure offers significant benefits, it’s essential to understand the risks, complications, and factors to consider before undergoing Liposuction in Dubai.

Agriculture has reached a new era in which data, automation, and smart technologies are transforming the approach to growing crops. The root of this revolution is the Smart Agriculture System,

Mild Steel (MS) pipes are the backbone of infrastructure development across sectors like construction, oil & gas, water supply, agriculture, and more. Their high tensile strength, affordability, and flexibility make

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.