In today’s fast-changing world, uncertainty is the only constant. Markets shift, technologies evolve, regulations change, and unexpected events-from global recessions to pandemics-can disrupt even the best-laid plans. For businesses, investors, and policymakers, preparing for the unknown is not optional; it’s essential. That’s where scenario analysis comes in.

Scenario analysis is a powerful decision-making tool that helps organizations anticipate possible futures, evaluate risks, and build strategies that remain resilient in different circumstances. Instead of trying to predict a single “right” future, scenario analysis acknowledges uncertainty and explores multiple possible outcomes.

Let’s break it down in simple terms: scenario analysis asks, “What could happen, and how would we respond?”

What is Scenario Analysis?

Scenario analysis is a method of forecasting that evaluates how different variables, risks, or external conditions might affect outcomes. It doesn’t try to guess the future with precision. Instead, it creates hypothetical scenarios-optimistic, pessimistic, and somewhere in between-to see how strategies hold up under different conditions.

For example:

- A bank might use scenario analysis to assess how rising interest rates could impact loan defaults.

- A business could explore what happens if supply chain disruptions continue for a year.

- An investor might analyze how stock portfolios perform under inflation, recession, or rapid growth.

The point is not to get every detail right, but to test resilience and prepare for what might happen.

Why is Scenario Analysis Important?

Traditional forecasting often assumes a “steady state” or a single likely future. But reality is rarely that simple. Scenario analysis matters because:

- It improves decision-making under uncertainty. By exploring multiple outcomes, businesses avoid tunnel vision and overreliance on one prediction.

- It highlights risks and opportunities. Scenarios reveal vulnerabilities (like weak cash flow in a downturn) but also highlight potential opportunities (like expansion during growth periods).

- It supports strategic planning. Leaders can design flexible strategies that adapt as conditions shift.

- It strengthens resilience. Organizations that think ahead are less likely to be caught off guard by crises.

Key Components of Scenario Analysis

To make scenario analysis effective, certain building blocks are needed:

- Drivers of Change: These are external or internal forces that could affect outcomes, such as market demand, regulations, technology, or global events.

- Variables and Assumptions: Factors like interest rates, sales volume, inflation, or competitor actions that shape different futures.

- Scenarios: Clear narratives about what might happen-usually ranging from best case to worst case.

- Impact Assessment: Quantifying how each scenario would affect performance metrics such as revenue, profit, market share, or customer satisfaction.

- Strategic Response: Plans or safeguards to mitigate risks and capitalize on opportunities.

Types of Scenario Analysis

There isn’t a one-size-fits-all approach. Organizations often use different types depending on their needs:

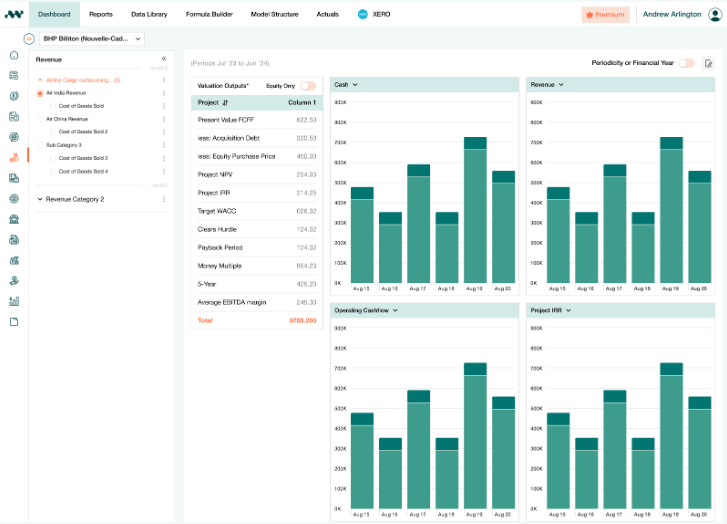

- Quantitative Scenario Analysis

Focused on numbers, this approach uses financial modeling or simulations. For example, a company might model profits under three economic conditions-recession, steady growth, or boom. - Qualitative Scenario Analysis

Instead of focusing on numbers, this approach builds descriptive narratives. It’s useful for strategic planning, where factors like politics, consumer behavior, or cultural trends are hard to quantify. - Stress Testing

A form of scenario analysis that pushes assumptions to extremes, such as what happens if revenue drops by 50% overnight. Banks and financial institutions often use stress tests to meet regulatory requirements. - Monte Carlo Simulation

A more advanced technique that runs thousands of simulations with different variables to see a range of possible outcomes and probabilities.

How to Conduct Scenario Analysis (Step-by-Step)?

Here’s a simple framework for applying scenario analysis:

- Define the objective. What decision are you testing-investment planning, risk management, or strategic growth?

- Identify key variables. Focus on factors with the greatest impact-like market demand, supply chain stability, or interest rates.

- Develop scenarios. Create at least three:

- Best-case scenario (optimistic)

- Base-case scenario (most likely)

- Worst-case scenario (pessimistic)

- Analyze the impact. Assess how each scenario affects financials, operations, or outcomes.

- Build strategies. Develop contingency plans or flexible strategies that adapt to each scenario.

- Review and update regularly. Scenario analysis is not a one-time exercise. Conditions change, so your scenarios should evolve too.

Real-World Examples of Scenario Analysis

- Energy Sector: Oil companies run scenarios based on crude oil prices, from extreme lows to sustained highs, to plan investments.

- Healthcare: Hospitals used scenario analysis during the COVID-19 pandemic to estimate patient surges and resource requirements.

- Finance: Portfolio managers test investment strategies under scenarios like inflation spikes or currency devaluations.

- Climate Policy: Governments model scenarios for climate change impacts to guide sustainability policies.

Benefits of Scenario Analysis

- Encourages long-term thinking beyond short-term forecasts.

- Helps organizations remain agile and adapt to unexpected shocks.

- Promotes risk awareness and proactive planning.

- Builds confidence among stakeholders, investors, and employees.

Limitations of Scenario Analysis

Of course, scenario analysis is not perfect. Some limitations include:

- Complexity: Building detailed, realistic scenarios requires time and resources.

- Subjectivity: The process depends heavily on assumptions, which may be biased.

- Uncertainty remains: No scenario can predict the future with certainty; it can only prepare you better.

Despite these challenges, it’s far more effective than relying on a single forecast.

The Future of Scenario Analysis

With advances in technology, scenario analysis is becoming more sophisticated. Artificial intelligence (AI) and big data allow organizations to model scenarios with real-time inputs and predictive analytics. Cloud-based platforms now let companies run complex simulations faster and more accurately than ever before.

In an era of rapid disruption, scenario analysis is evolving from a planning exercise into a core business capability-helping organizations stay resilient, competitive, and forward-looking.

Final Thoughts

Scenario analysis is not about predicting the future-it’s about preparing for it. By exploring different possibilities, organizations can better navigate uncertainty, identify risks, and seize opportunities.

Whether you’re an investor, business leader, or policymaker, scenario analysis offers a structured way to think about the “what-ifs” and make smarter, more resilient decisions.

In a world where change is constant, the question is not if you should use scenario analysis, but how soon you can start applying it.