If you are planning to apply for an IPO, one term you will hear almost every day is IPO GMP. Many investors make decisions based on it, but very few actually understand what it means and how reliable it is.

In this guide, we will explain IPO GMP in simple language, how to use it smartly, and why platforms like ipowatch are popular for tracking it.

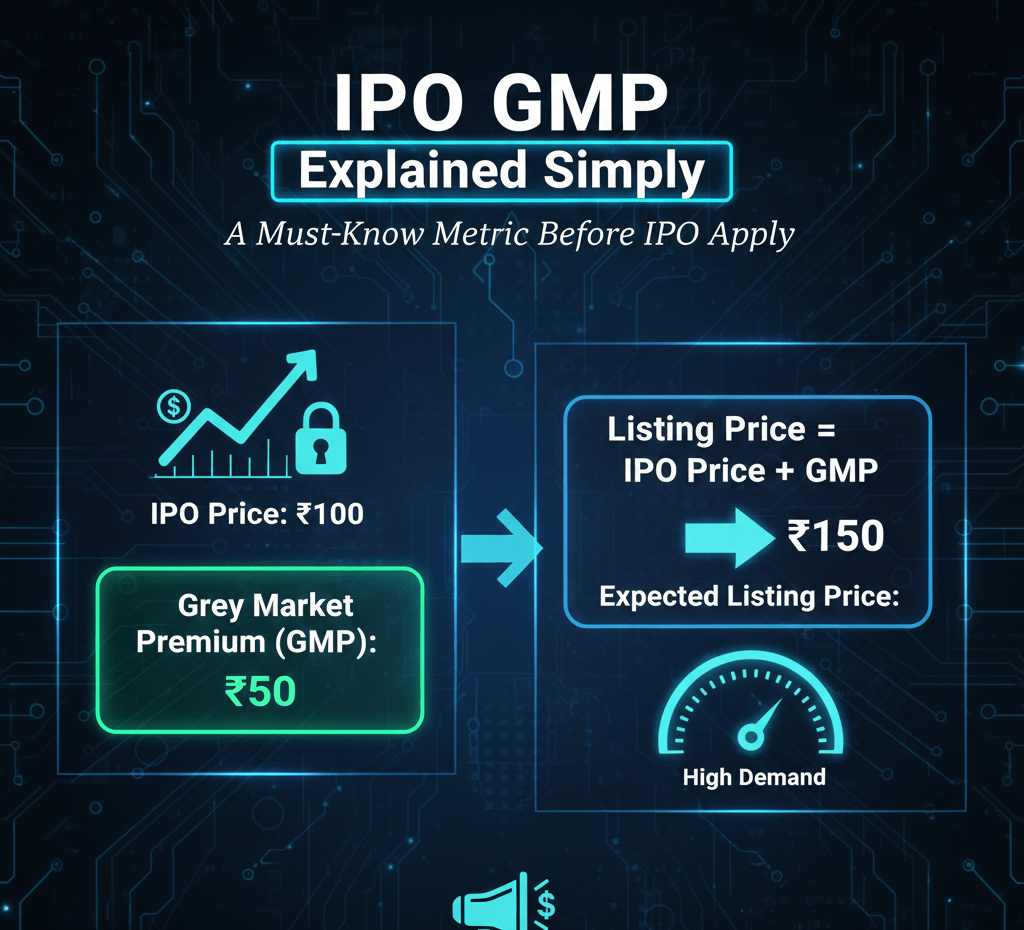

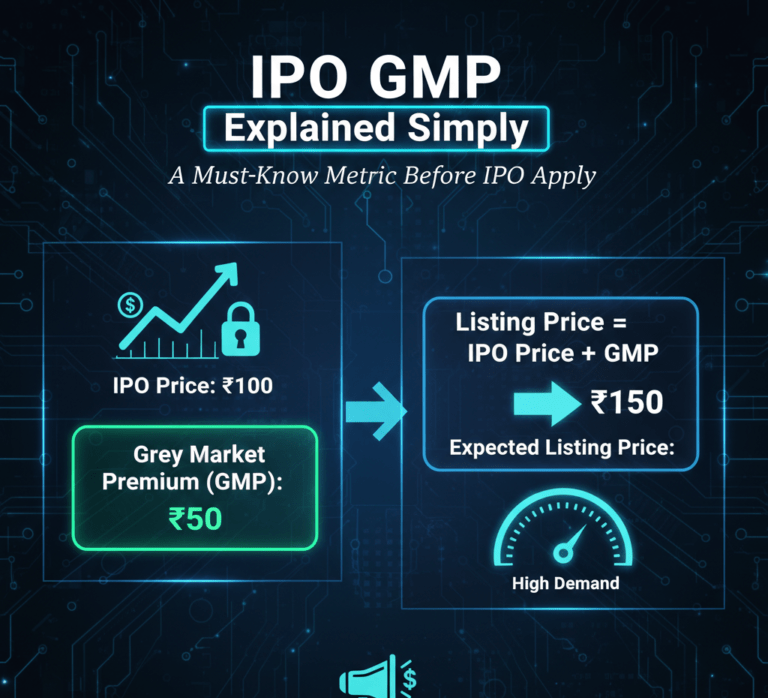

What is IPO GMP? (Grey Market Premium)

IPO GMP stands for Grey Market Premium.

It is the extra price at which IPO shares are traded unofficially before they get listed on the stock exchange.

For example:

If an IPO price is ₹100 and GMP is ₹40, it means people are willing to buy that share at ₹140 in the grey market.

So expected listing price =

IPO price + GMP = Possible listing price

Why is IPO GMP Important for Investors?

IPO GMP gives you a quick idea about market sentiment.

High GMP usually means:

Strong demand

Good listing gains expected

Positive investor interest

Low or negative GMP means:

Weak demand

Risk of poor listing

Market not confident

That’s why many retail investors check ipowatch daily before applying for any IPO.

Is IPO GMP Always Accurate?

Short answer: No. But it’s useful.

IPO GMP is:

Unofficial

Based on demand and rumors

Influenced by market mood

Sometimes:

High GMP IPO lists flat

Low GMP IPO gives surprise profits

So IPO GMP should be used as:

A reference, not a final decision tool.

How to Check IPO GMP & Status of IPO Allotment

You can track IPO updates from:

ipowatch

NSE & BSE official websites

Broker platforms

After applying, you can check:

status of allotment of ipo

status of ipo allotment

using your PAN number on the registrar’s website.

This helps you know:

Whether you got shares

How many shares are allotted

Refund status

Smart Strategy to Use IPO GMP

Professional investors follow this rule:

Check IPO GMP trend

Check company fundamentals

Check subscription data

Then apply

Never apply only because GMP is high.

A good IPO decision =

GMP + Financials + Market conditions

IPO GMP vs Long-Term Investing

IPO GMP is mainly for:

Short-term listing gains

If you are a long-term investor, focus more on:

Company business model

Revenue growth

Profitability

Industry potential

GMP won’t matter after 1–2 years.

IPO GMP is like a temperature indicator of the market.

It tells you how hot the demand is, but not whether the company is truly strong.

Use it smartly, track it on iPoWatch, and always combine it with real research.

IPO GMP should guide your decision, not control it.