We value your privacy

We use cookies to enhance your browsing experience, serve personalized ads or content, and analyze our traffic. By clicking "Accept All", you consent to our use of cookies.

We use cookies to help you navigate efficiently and perform certain functions. You will find detailed information about all cookies under each consent category below.

The cookies that are categorized as "Necessary" are stored on your browser as they are essential for enabling the basic functionalities of the site. ...

Necessary cookies are required to enable the basic features of this site, such as providing secure log-in or adjusting your consent preferences. These cookies do not store any personally identifiable data.

No cookies to display.

Functional cookies help perform certain functionalities like sharing the content of the website on social media platforms, collecting feedback, and other third-party features.

No cookies to display.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

No cookies to display.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

No cookies to display.

Advertisement cookies are used to provide visitors with customized advertisements based on the pages you visited previously and to analyze the effectiveness of the ad campaigns.

No cookies to display.

we explore the best PVC ball valve options available, their key features, benefits, and the applications where they offer maximum value.

Outsourced estimators often use industry-standard software such as Xactimate, PlanSwift, Bluebeam Revu, and Microsoft Excel. These tools support detailed and accurate outsourcing cost estimation across a variety of project types.

If you’ve ever had a sudden toothache or some unexpected dental pain, you probably know how uncomfortable and scary it can feel. Maybe you even thought, “I’ll wait a day

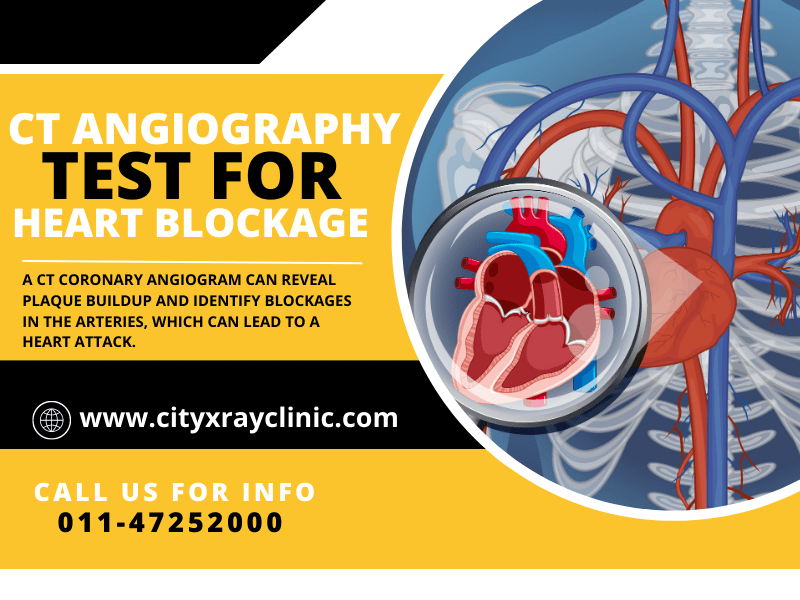

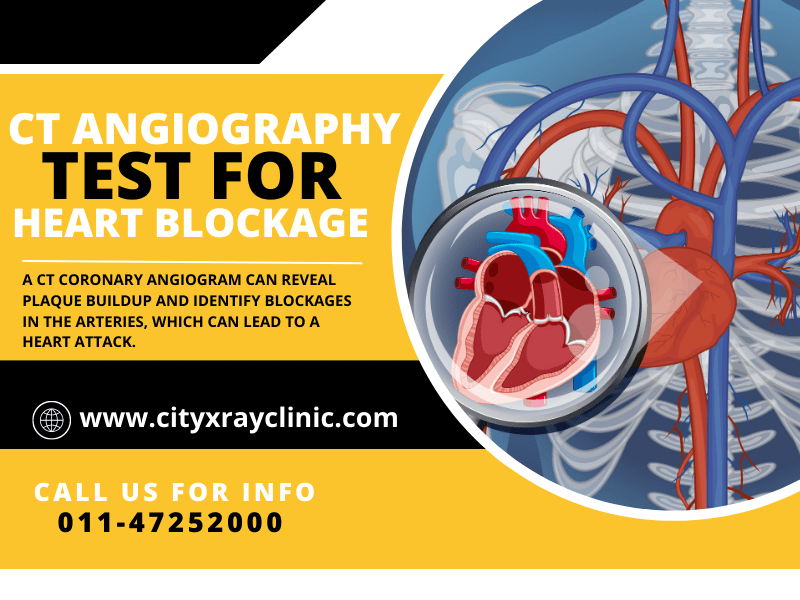

CT Coronary Angiography price is one of the most commonly searched concerns for individuals advised to undergo this non-invasive heart test. With the growing number of heart-related conditions, timely and

Europe has become one of the most sought-after destinations for Indian students aspiring to pursue higher education. The combination of world-class universities, diverse cultures, and relatively affordable education makes it

A mobile stage is built within a vehicle or trailer and can be easily set up at your location after arrival. Unlike regular stages, Outdoor Mobile Stage Concerts are much faster and easier to put together, requiring little time and fewer workers.

If you’re on a mission to gain muscle, pack on some healthy weight, or just boost your calorie intake, you probably already know that eating enough can be a challenge.

When it comes to eye care, choosing the right hospital is essential for preserving your sight and ensuring a lifetime of healthy vision. If you’re searching for a reliable and advanced eye hospital near Patiala, your search ends at Netra Prakash Eye Centre.

If you’re someone who loves sprucing up your home with small but impactful details, you’ve probably heard about ceramic knobs becoming all the rage lately. But not all ceramic knobs

Introduction to Superbond – Leading Adhesive Solutions in India Superbond is the leading manufacturer of adhesives in India due to the flexible and dependable performance of its adhesives. Also, Superbond

Discover expert hiring solutions by Human Asset HR, a recruitment agency in Mumbai specializing in senior and middle-level talent acquisition.

Learn how top PPC marketers track what matters – from micro-conversions to smart attribution – and optimize campaigns like pros.

This guide explores the essential questions every parent should ask when selecting a pediatric dentist.

SEO Gupta Auther : Expert SEO guest post writer boosting online visibility.

As with any cosmetic treatment, success depends on choosing an experienced provider. A consultation with a board-certified specialist will help you determine if Laser Liposuction is the right choice for your aesthetic goals.

Global Green Mining Market Poised for Sustainable Expansion Through 2030 The global Green Mining Market Size, offering eco‑efficient solutions for mineral extraction and processing, is witnessing robust expansion. In 2023, this industry

Artificial Intelligence is no longer just a buzzword—it's becoming one of the most disruptive forces in Web3. In 2025, the best AI crypto presale projects are those that seamlessly blend

Best Ad Network for Publisher

ABA therapy in schools supports children’s learning, behavior, and social skills, helping them thrive in a structured, inclusive environment.

If you’ve ever wondered how to instantly make your living room feel a bit more fancy and cozy, I’ve got a little secret for you—velvet cushion covers. Yep, those soft,

Ranks rocket connects website owners with bloggers for free guest posting! Increase brand awareness and backlinks with strategic placements. But remember, quality content is key.