Forex trading is popular because it offers flexibility. Traders can access the market from almost anywhere, and trading sessions run throughout the day. However, one question always comes to mind for both new and experienced traders: what was the actual outcome of this trade?

Understanding how to calculate trade results in forex trading is a basic but very important skill. Without clarity, trading decisions often become assumptions instead of planned actions.

In this guide, we explain trade calculation in forex using simple language and show how an online trading tool can make this process easier and more accurate.

What Does Trade Outcome Mean in Forex Trading?

In forex trading, the trade outcome is the difference between the entry price and the exit price. This difference is measured in pips. The final result depends on several factors, such as:

-

The currency pair being traded

-

Trade size

-

Total pip movement

-

Account currency

Even a small price movement can have a noticeable impact depending on trade size and position direction.

Basic Method of Calculating Forex Trade Results

When traders calculate results manually, they usually follow a basic calculation method:

Trade Result = Price Difference × Trade Size × Pip Value

While this method works in theory, it often becomes confusing in real trading situations, especially when multiple trades or different currency pairs are involved.

Let’s understand this with a simple example.

Example of Manual Trade Calculation

Assume a trader places a position on EUR/USD:

-

Entry price: 1.1000

-

Exit price: 1.1050

-

Total movement: 50 pips

-

Trade size: 1 standard lot

Based on pip value, the final trade result is calculated manually. While this may seem easy, repeating such calculations regularly increases the chances of mistakes.

Limitations of Manual Trade Calculation

Manual calculation may help beginners understand the basics, but it has several limitations:

-

Higher chances of human error

-

Time-consuming during active market hours

-

Confusing for cross-currency trades

-

Difficult to manage with multiple positions

Because of these challenges, many traders prefer automated solutions.

What Is an Online Forex Calculation Tool?

An online forex calculation tool is designed to estimate trade outcomes automatically. Traders simply enter basic trade details, such as:

-

Currency pair

-

Position direction

-

Trade size

-

Entry and exit prices

The tool then instantly displays the estimated trade outcome, removing the need for manual calculations.

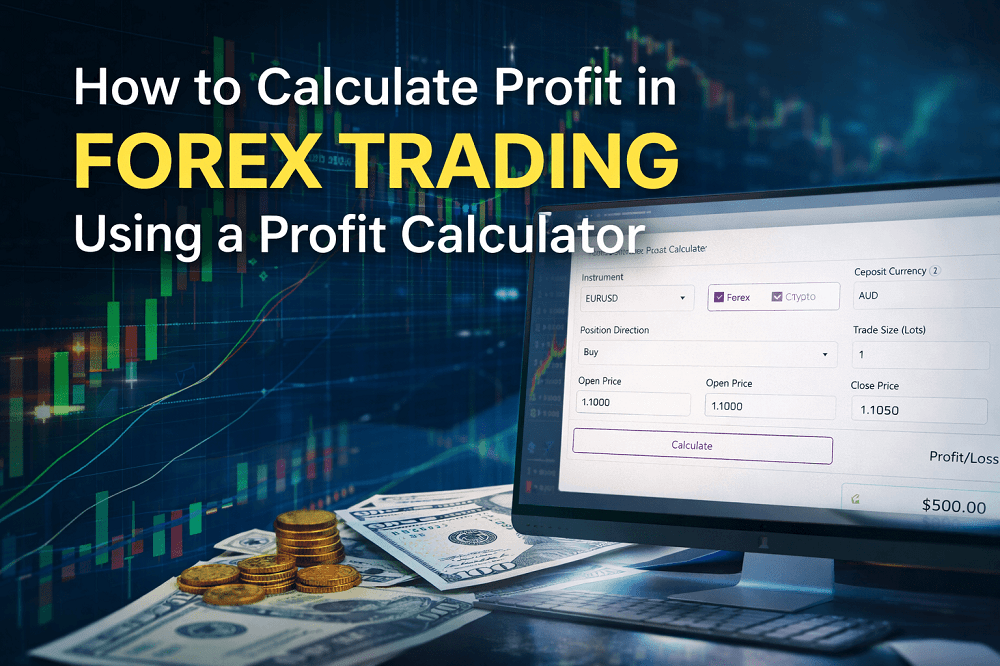

How to Calculate Trade Results Using an Online Tool

Using an online tool is simple and beginner-friendly:

Step 1: Select the currency pair

Step 2: Choose position direction

Step 3: Enter trade size

Step 4: Add entry and exit prices

Step 5: Click calculate

Within seconds, the tool shows the estimated trade outcome along with supporting details.

Advantages of Using an Online Calculation Tool

Online tools offer several benefits to traders:

-

Accurate calculations

-

Faster decision-making

-

Reduced mental pressure

-

Better trade planning

-

Suitable for all experience levels

Knowing potential outcomes in advance helps traders stay disciplined and focused.

Trade Calculation and Planning

Trade calculation plays an important role in planning. Before entering a position, traders should have a clear idea of:

-

Expected outcome

-

Possible downside

-

Position sizing

Using an online calculation tool allows traders to compare different scenarios and make informed decisions.

Common Errors Traders Make While Estimating Trades

Some common mistakes include:

-

Misjudging pip value

-

Incorrect trade size

-

Ignoring trading costs

-

Making assumptions without calculation

Using a calculation tool helps reduce these errors significantly.

Who Can Benefit from an Online Forex Tool?

Such tools are useful for:

-

New forex traders

-

Day traders

-

Swing traders

-

Trading learners and educators

No matter the experience level, accurate calculation remains essential.

Final Thoughts

Learning how to calculate trade results in forex trading is a core skill every trader should develop. While manual methods help with understanding, automated tools make the process faster, cleaner, and more reliable.

Traders who calculate before acting usually make more consistent decisions. In forex trading, clarity leads to confidence, and proper calculation provides that clarity.