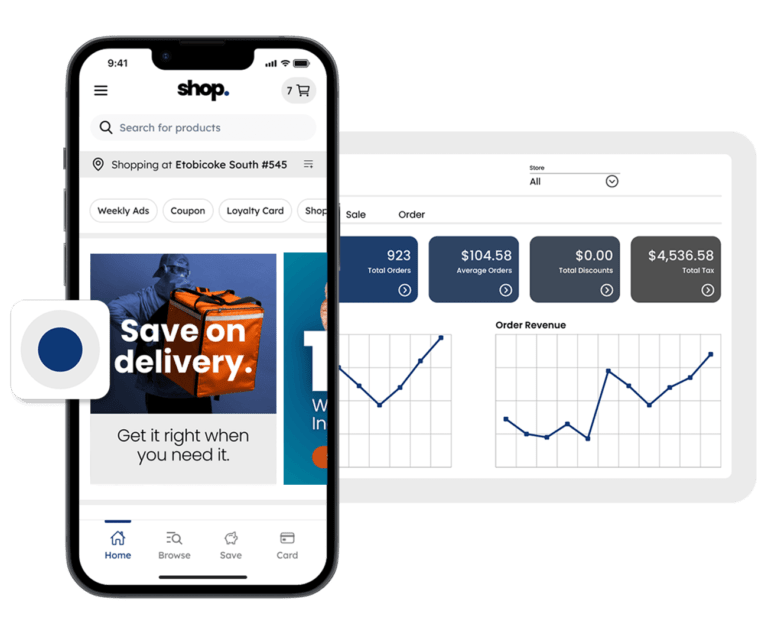

Whether you’re starting a new venture, expanding operations, or simply managing day-to-day expenses, accessing capital through a business loan is a common and essential step. But before committing to any financial obligation, it’s vital to understand how much you’ll need to repay—and that’s where a business loan calculator comes into play.

This guide walks you through what a business loan calculator is, how it works, why it matters, and how it helps streamline your financial planning and business financing strategy.

What Is a Business Loan Calculator?

A business loan calculator is an online financial tool designed to help entrepreneurs and business owners estimate their monthly loan repayments—commonly referred to as EMIs (Equated Monthly Installments)—based on the principal amount, interest rate, and loan tenure.

It provides a clear snapshot of your financial commitment, allowing you to make informed decisions before signing any loan agreement.

Why Do You Need a Business Loan Calculator?

Taking a loan is more than just receiving a lump sum of money; it’s a long-term financial responsibility. A business loan calculator simplifies complex financial data, allowing you to:

🔹 Estimate EMIs Accurately

Forget pen-and-paper calculations. This tool quickly provides precise monthly repayment amounts, helping you assess affordability.

🔹 Visualize the Loan Amortization Schedule

Most calculators display a breakdown of principal and interest over time, also known as the loan amortization table. This helps you understand how much of your monthly payment is reducing the principal amount versus how much goes toward interest.

🔹 Plan Cash Flow and Working Capital

Knowing your EMI helps you manage working capital, overheads, and other business expenses more efficiently without risking default.

🔹 Compare Loan Offers

Planning to choose between multiple lenders or loan products? A calculator allows you to compare interest rates, tenure options, and overall costs across offers.

Core Components of a Business Loan Calculator

1. Principal Amount

This is the original loan amount you intend to borrow. It directly impacts the size of your EMI—the larger the principal, the higher the monthly installment.

2. Interest Rate

This is the lender’s annual percentage rate or APR. Even small changes in interest rates can significantly affect the total repayment amount.

3. Loan Tenure

This refers to the length of the loan, usually measured in months or years. Smaller EMIs but higher interest over time are associated with a longer tenure.

How Does a Business Loan Calculator Work?

The EMI is calculated using the following formula:

EMI = [P × R × (1+R)^N] / [(1+R)^N – 1]

Where:

- P = Principal loan amount

- R = Monthly interest rate

- N = Total number of monthly installments

Let’s break this down with a realistic example.

🔍 Example: Calculating Business Loan EMI

Suppose you take a commercial loan of $200,000 at an interest rate of 12% per annum for a period of 4 years (48 months).

- Loan Amount (P) = $200,000

- Interest Rate (Annual) = 12% → Monthly Interest (R) = 1% or 0.01

- Tenure (N) = 48 months

Using the formula:

EMI = [200,000 × 0.01 × (1+0.01)^48] / [(1+0.01)^48 – 1]

≈ $5,263.13

So your monthly EMI would be approximately $5,263, with a total repayment of $252,631, and interest paid = $52,631 over 4 years.

Benefits of Using a Business Loan Calculator

Here’s why entrepreneurs across industries rely on business loan EMI calculators:

✅ Improved Financial Visibility

It eliminates ambiguity and gives you a complete picture of the financial obligation tied to the loan.

✅ Effective Working Capital Management

Knowing your exact EMI helps you plan business operations, salaries, inventory, and overheads while maintaining sufficient working capital.

✅ No Hidden Surprises

You can include processing fees, prepayment charges, or GST (if applicable) for a more realistic picture of loan cost.

✅ Customizable

Adjust inputs like loan amount, interest rate, or tenure to simulate different scenarios before making a borrowing decision.

Applications: When to Use a Business Loan Calculator

The calculator is ideal for any type of business loan, including:

- ✅ Startup Financing

- ✅ Small Business Loans

- ✅ SBA Loans (U.S.)

- ✅ Equipment Financing

- ✅ Invoice Discounting

- ✅ Working Capital Loans

- ✅ Short-Term Loans

- ✅ Line of Credit Analysis

Tips for Smart Loan Planning Using a Calculator

Aim for a Healthy EMI-to-Income Ratio

Ideally, your EMI should not exceed 30-40% of your business’s monthly income.

Review the Total Interest Payable

Opting for a longer tenure might reduce EMI but could increase total interest significantly.

Watch for Processing Fees

Add any upfront charges to your calculations for a true cost estimate.

Check for Prepayment Flexibility

Prepaying part of the loan early? Some calculators let you simulate early repayment scenarios.

Frequently Asked Questions (FAQs)

Are interest rates fixed or variable?

They can be either. A fixed-rate means your EMI won’t change. A floating rate means your EMI may increase or decrease based on market conditions.

Does the calculator include tax benefits?

Most calculators do not account for tax benefits like interest deductions. Consult your accountant for tax-related insights.

Conclusion

In today’s competitive and fast-paced market, understanding your loan commitments is crucial. A business loan calculator empowers entrepreneurs to plan, assess risk, and make decisions based on accurate data—not guesswork.

Whether you’re seeking funds for expansion, inventory, machinery, or marketing, this tool gives you the financial clarity you need. Don’t take out a loan without it.