Entering the stock market can be both exciting and overwhelming, especially for first-time investors. With numerous trading platforms, investment options, and financial tools available, it becomes critical to start with a reliable broker that not only facilitates trading but also supports learning and long-term wealth creation. One of the most attractive offerings for new investors is a demat account with zero annual maintenance charges (AMC). By eliminating maintenance fees while providing full access to trading and research tools, this combination makes it easier for beginners to enter the stock market confidently. Choosing the best stock broker in India with a demat account at no additional cost ensures cost savings, convenience, and secure trading—all essential factors for a successful investment journey.

Why a No-Cost Demat Account is Important for Investors

A demat account, short for “dematerialized account,” allows investors to hold shares and securities in electronic form. It is a fundamental requirement for trading in the stock market. For beginners, a demat account without maintenance charges offers multiple advantages:

-

Cost Efficiency: Eliminating annual maintenance fees allows more capital to be invested in stocks or mutual funds.

-

Ease of Access: Zero-cost accounts reduce financial barriers, encouraging beginners to start trading.

-

Seamless Integration: Demat accounts bundled with trading platforms enable smooth transactions.

-

Portfolio Management: Real-time updates on holdings, dividends, and corporate actions simplify investment tracking.

When paired with a trusted broker, a demat account with no AMC becomes more than a cost-saving tool—it becomes a gateway to professional-grade trading resources.

Features of the Best Stock Broker in India with No-Cost Demat Account

1. Simple Account Opening Process

The ideal best stock broker in India provides paperless account setup, allowing investors to complete KYC and verification digitally. Online onboarding reduces paperwork and accelerates access to the markets.

2. Zero Annual Maintenance Charges

A genuinely no-cost demat account eliminates AMC while offering the same level of security and functionality as a paid account.

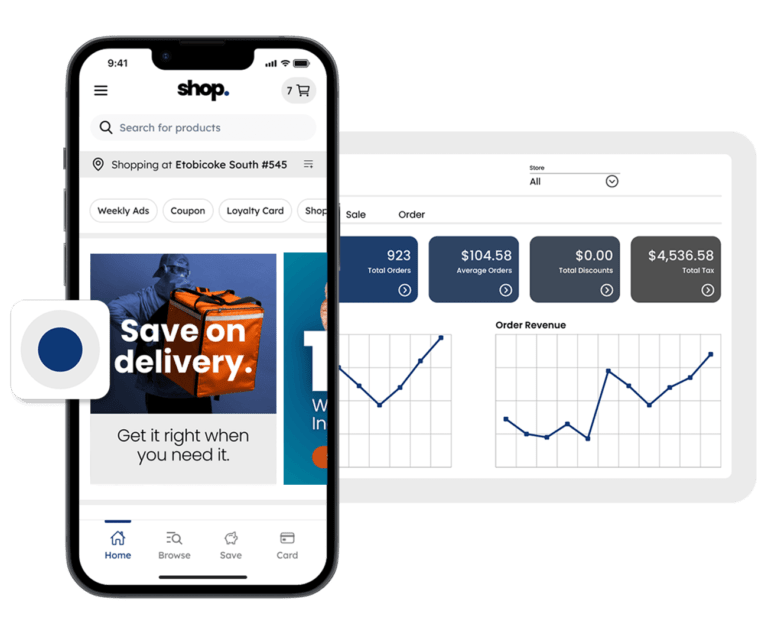

3. Advanced Trading Platforms

The broker should provide intuitive web and mobile platforms with real-time data, market news, charts, and analysis tools to facilitate informed decision-making.

4. Comprehensive Research Support

Access to in-depth research reports, stock analysis, market trends, and expert insights helps beginners make better investment choices.

5. Mobile and Web Trading

Both mobile apps and web dashboards enable investors to monitor markets, execute trades, and track portfolios from anywhere, ensuring flexibility and convenience.

6. Secure Transactions

Bank-level encryption, two-factor authentication, and secure fund transfer protocols are essential to protect personal and financial data.

7. Customer Support and Educational Resources

24×7 support, tutorials, webinars, and demo accounts ensure that beginners have all the guidance they need to trade confidently.

Benefits of a No-Cost Best Demat Account in India

1. Reduced Investment Costs

Accounts with no AMC help investors save on maintenance charges, allowing more capital to be invested in securities.

2. Easy Portfolio Management

Integrated demat and trading accounts streamline investment tracking, profit/loss monitoring, and asset allocation.

3. Access to Multiple Securities

Investors can trade in equities, bonds, mutual funds, ETFs, and even commodities, all within one platform.

4. Beginner-Friendly Environment

Eliminating AMC, coupled with educational resources, provides beginners with a risk-managed and beginner-friendly environment.

5. Seamless Transactions

Real-time trade execution, instant fund transfers, and clear transaction history improve efficiency and transparency.

Technology Enhancements in Modern Brokerage

Technology has revolutionized how investors trade and manage their portfolios:

-

AI-Driven Insights: Predicts stock trends and risk factors, guiding beginner investors.

-

Mobile Trading: Enables on-the-go trading with live data and alerts.

-

Cloud-Based Security: Keeps records and transaction histories safe and accessible.

-

Advanced Analytics: Tools like technical charts, trend indicators, and predictive analytics help investors make data-driven decisions.

By leveraging technology, brokers empower beginners to trade efficiently while gaining practical knowledge of market dynamics.

Tips for Beginners Using a No-Cost Demat Account

-

Start Small: Allocate a modest investment initially until comfortable with market dynamics.

-

Diversify Portfolio: Spread investments across sectors and asset classes to reduce risk.

-

Set Stop-Loss Orders: Protect capital from sudden market downturns.

-

Stay Informed: Follow market news, research reports, and company updates.

-

Track Portfolio Performance: Regularly review gains, losses, and allocation to optimize returns.

-

Avoid Emotional Trading: Base decisions on data and analysis rather than hype or rumors.

These practices help beginners establish a disciplined approach to investing and gradually improve their market skills.

Common Mistakes to Avoid

-

Ignoring Hidden Charges: Even accounts without AMC may have transaction fees; always verify costs.

-

Overtrading: Frequent buying and selling can lead to losses and high costs.

-

Skipping Research: Avoid investing without understanding company fundamentals or market trends.

-

Neglecting Portfolio Reviews: Regular assessment ensures investments align with goals.

-

Following Hype: Avoid making decisions based solely on market rumors or short-term trends.

The right broker mitigates these risks by providing analytical tools, alerts, and expert guidance.

Mobile Trading: Flexibility and Convenience

Mobile apps allow beginners to:

-

Execute trades instantly

-

Monitor portfolio performance and asset allocation

-

Receive push notifications for price alerts and corporate actions

-

Access educational resources and demo accounts

For beginners, mobile trading promotes engagement, learning, and timely decision-making.

The Importance of Customer Support

Responsive support is essential for beginner investors:

-

Helps with account opening and KYC verification

-

Assists with fund transfers and order execution

-

Provides technical support for app or platform issues

-

Offers guidance on using trading tools and understanding reports

Strong customer support ensures a smooth trading experience and reduces the risk of errors.

Final Thoughts

Opening an account with the best stock broker in India that offers a demat account with no annual maintenance charges is an ideal choice for beginners seeking secure, cost-effective, and technologically advanced trading solutions. These platforms provide an integrated ecosystem for trading, research, education, and portfolio management.

When combined with the best demat account in India, investors gain a complete solution that streamlines transactions, enhances learning, and ensures transparent and efficient trading. This combination empowers beginners to trade confidently, manage risks, and build a foundation for long-term financial growth in India’s stock markets.