Every business faces risks that can strike without warning. One day, everything feels under control, and the next, a sudden fire, storm, or break-in can destroy equipment, inventory, or essential records. Imagine your team arriving to find a flooded warehouse or a broken storefront window. The panic, the uncertainty, and the financial impact can be overwhelming.

Many business owners operate under the assumption that accidents only happen to others. The truth is that property damage can happen to anyone at any time. Recovery is rarely simple. Repair costs, replacement of assets, and lost revenue can add up quickly, sometimes threatening months of hard work.

This is why Commercial Property Insurance Services in Texas are not just helpful, they are essential. The right coverage safeguards your property, maintains business continuity, and gives you confidence to recover quickly. At Firstline Insurance Agency, we help business owners protect their operations and property with coverage that is clear, reliable, and tailored to their specific needs. Here are seven ways Commercial Property Insurance can protect your business from the unexpected.

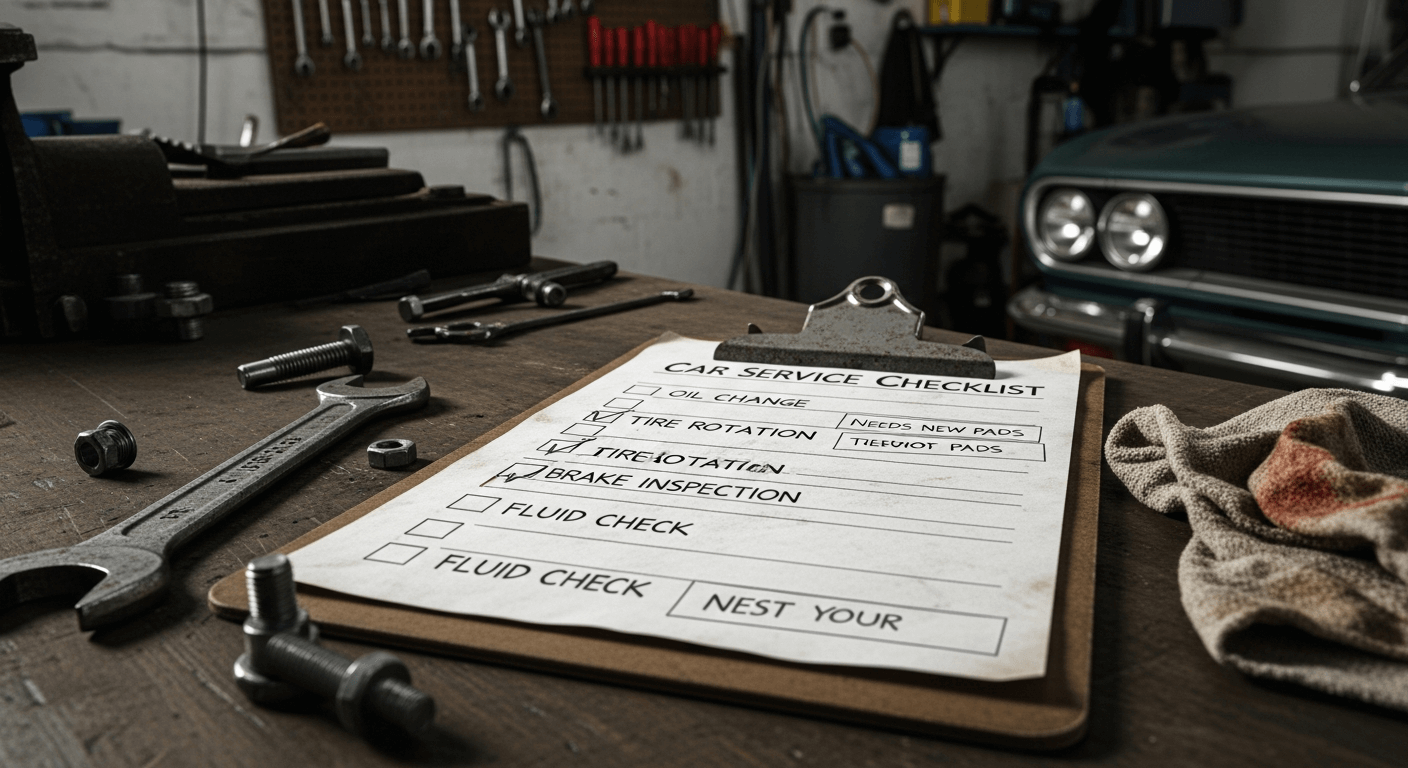

- Protect Your Physical Assets before Disaster Strikes

Your building, inventory, machinery, and equipment are the foundation of your business. Even small damages can lead to significant expenses if not covered. Texas Commercial Property Insurance ensures that all your critical assets are protected. This means that if a fire damages your office or a storm floods your warehouse, your business can recover quickly without draining your budget.

Think of it as a shield for the things that keep your business running. When an incident happens, you won’t have to scramble for funds to fix or replace everything.

- Keep Your Business Running, No Matter What

Property damage doesn’t just hurt your assets it can stop your business in its tracks. Every day of downtime equals lost revenue, missed opportunities, and frustrated customers. Commercial Property Insurance Services in Texas often include business interruption coverage, which compensates for lost income while repairs are underway.

This type of protection allows you to stay operational, even when your physical space is temporarily unusable. Your customers remain satisfied, and your employees remain productive.

- Protect Against Unexpected Disasters

Disasters rarely announce themselves. Fires, water damage, storms, or theft can happen in an instant. Without coverage, the costs of recovery can be overwhelming. Commercial Property Insurance provides a safety net for these unpredictable situations.

This protection ensures that a single event does not derail your entire business. It helps you recover faster, maintain operations, and avoid the stress of unexpected financial burdens.

- Coverage That Fits Your Unique Business

No two businesses are alike. A restaurant faces different risks than a warehouse, and an office has different exposures than a retail shop. Commercial Property Insurance Services in Texas can be tailored to fit your specific operations.

At Firstline Insurance Agency, we assess your business, identify risks, and create a policy that covers the assets and operations that matter most. This personalized approach means your business is not overpaying for unnecessary coverage, but everything critical is fully protected.

- Protect Your Employees and Maintain Workflow

Property damage affects more than just your assets it affects your team. Equipment loss, damaged inventory, or temporary closures can disrupt workflow and slow productivity. Commercial Property Insurance ensures that employees can continue working and daily operations remain supported during recovery.

This means your team can focus on delivering results instead of dealing with chaos caused by property damage. Protecting your employees’ workflow is just as important as protecting your assets.

- Financial Peace of Mind

Running a business is stressful enough without worrying about accidents or disasters. Insurance provides financial peace of mind by covering repairs, replacements, and lost income. Commercial Property Insurance Services allow you to focus on growing your business and serving your customers without constantly asking, “what if something goes wrong?”

This reassurance lets you make bold decisions for growth and innovation, knowing your assets and operations are protected.

- Scale Your Coverage as Your Business Grows

Businesses evolve. You may expand operations, acquire more assets, or open new locations. Your insurance needs change along with your growth. Commercial Property Insurance is flexible and scalable, allowing your coverage to grow with your business.

Regular reviews and updates ensure that nothing is left unprotected. This proactive approach keeps your business secure at every stage and ensures long-term continuity.

Why Choose Firstline Insurance Agency

Finding an insurance provider who understands your business is critical. At Firstline Insurance Agency, we provide Commercial Property Insurance Services that are transparent, personalized, and reliable.

We guide business owners through every step, helping them understand coverage, assess risks, and create a plan that protects assets, operations, and revenue. With our expertise, you gain the confidence to face unexpected events and keep your business running smoothly.

Takeaway

Every business faces risks, but losses don’t have to be devastating. Texas Commercial Property Insurance protects your property, operations, and future growth. From safeguarding your physical assets to covering business interruptions, insurance is more than a policy it is a strategy for resilience.

Investing in Commercial Property Insurance Services with Firstline Insurance Agency means securing your business against the unexpected. Protect your property, maintain operations, and focus on growth with confidence, knowing that your business is prepared for whatever comes next.