SLBM Full Form: SLBM NSE Mechanism & Best Stock List Guide

Introduction

Have you ever wondered how traders borrow stocks just like borrowing books from a library? Sounds unusual, right? Yet, this is exactly what happens in the stock market through something called SLBM. Whether you’re a curious beginner, a self-taught investor, or someone enrolled in online stock trading courses, understanding SLBM can give you a real edge.

In this article, we’ll dive deep into the SLBM full form, its NSE mechanism, and a beginner-friendly SLBM stock list. By the end, you’ll feel more confident about this powerful feature of the stock market.

Learn SLBM full form, slbm mechanism, slbm in stock market, slbm stock list & find best picks. Helpful for beginners & online stock trading courses.

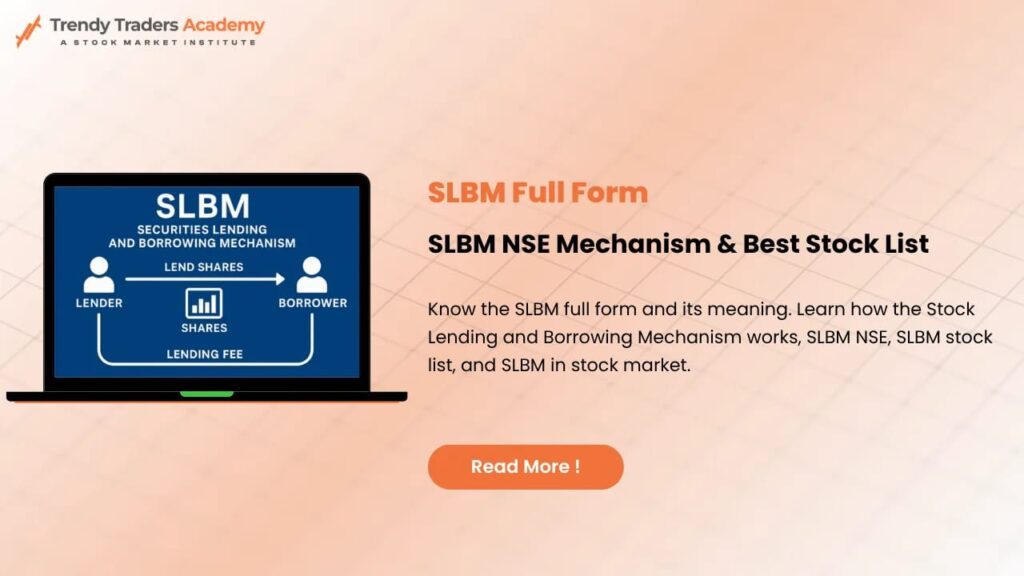

Understanding the SLBM Full Form

SLBM stands for Stock Lending and Borrowing Mechanism.

It’s a regulated system in India where traders can lend or borrow shares for a fixed period.

Think of it like renting a car. The lender owns the car (stock), while the borrower uses it temporarily with an agreement to return it later.

Why SLBM Exists in the Stock Market

SLBM was introduced to:

- Make short selling smoother and safer

- Improve market liquidity

- Allow long-term investors to earn extra income

- Protect traders from settlement shortfalls

Before SLBM, short sellers often struggled to find shares to borrow. Today, SLBM solves that problem.

How SLBM Works: SLBM Mechanism Explained

The slbm mechanism is simple yet systematic.

Borrower’s Perspective

A trader borrows shares expecting the price to fall.

Steps include:

- Select the stock

- Borrow it through SLBM

- Sell it in the market

- Buy back later at a lower price

- Return the shares

Lender’s Perspective

An investor lends idle shares and earns a lending fee without selling the stock.

SLBM in stock market ensures that the entire process is:

- Transparent

- Regulated

- Automated

Key Participants in SLBM

There are three main players:

1. Lenders

Long-term investors who lend shares for extra income.

2. Borrowers

Traders who need shares for short selling or arbitrage.

3. Clearing Corporation

Acts as the guarantor to ensure smooth settlement.

SLBM vs Intraday vs Futures: What’s the Difference?

Intraday Trading

Buy and sell on the same day. No borrowing.

Futures Trading

Trade contracts with leverage. Higher risk.

SLBM

Borrow actual shares for delivery-based short selling.

SLBM gives traders more flexibility compared to intraday and more control than futures.

Benefits of Using SLBM in Stock Market

1. Low Risk for Lenders

They continue earning dividends and corporate benefits.

2. Extra Income Opportunity

Lending fees can be significant for high-demand stocks.

3. Safe and Regulated Mechanism

NSE ensures transparent settlement.

4. Helpful for Short Sellers

SLBM is the backbone for efficient short selling.

Risks Every Trader Must Know

Even though SLBM is safe, risks include:

- Volatility risk

- Higher borrowing fees during demand spikes

- Settlement delays in rare cases

- Corporate action adjustments

Borrowers especially must monitor stock trends carefully.

SLBM Charges & Settlement Cycle

Charges Involved

- Borrowing fee

- Brokerage

- Exchange charges

- GST

Settlement Cycle

Most SLBM contracts follow the T+1 or T+2 cycle, depending on the stock and duration.

SLBM NSE Rules & Eligibility

NSE lists only specific stocks eligible for SLBM.

Rules include:

- Minimum quantity requirement

- Margin rules for borrowers

- Lenders must have shares in demat

- Borrowers must square off within contract expiry

Best SLBM Stock List for Beginners

Here is a simplified slbm stock list based on popularity, liquidity, and demand for short selling:

- Reliance Industries

- HDFC Bank

- ICICI Bank

- Infosys

- TCS

- Tata Motors

- SBI

- HCL Tech

- Axis Bank

- Maruti Suzuki

These stocks tend to have:

- High liquidity

- Lower borrowing costs

- Steady demand

How to Check SLBM Stock Availability

You can check availability on:

- Your broker’s platform

- NSE’s Stock Lending & Borrowing page

- RMS or margin dashboard

Look for:

- Available quantity

- Borrowing fee

- Contract duration

SLBM Strategies for Retail Traders

1. Short Selling in Bearish Markets

Borrow high and return low.

2. Arbitrage Opportunities

Price difference between cash and derivatives markets.

3. Lending Strategy for Passive Investors

Earn without selling stock.

4. Pre-Event Borrowing

Useful before earnings or news announcements.

Role of SLBM in Short Selling

Without SLBM, short selling would be chaotic.

SLBM provides:

- Guaranteed stock delivery

- Transparent borrowing fees

- Risk protection through clearing corporations

This mechanism builds market confidence and reduces manipulation.

How Online Stock Trading Courses Teach SLBM

Most online stock trading courses include:

- SLBM fundamentals

- How to borrow and lend

- Risk management

- Short selling strategies

- Platform walkthroughs

Learning SLBM through structured courses helps beginners trade with confidence.

Final Thoughts

SLBM may sound technical at first, but once you understand its purpose, it becomes one of the most practical tools in the stock market. Whether you’re looking to earn extra income or trade strategically, mastering the slbm mechanism and knowing the right slbm stock list can give you a strong advantage.

FAQs

1. What is the full form of SLBM in the stock market?

SLBM stands for Stock Lending and Borrowing Mechanism, a system for borrowing and lending shares.

2. How does SLBM help in short selling?

SLBM allows traders to borrow shares and sell them, making short selling regulated and safer.

3. Is SLBM risky for lenders?

Risk is low because lenders retain ownership benefits, and the clearing corporation guarantees settlement.

4. Which stocks are best for SLBM?

Highly liquid stocks like Reliance, HDFC Bank, SBI, Infosys, and Tata Motors are commonly preferred.

5. Can beginners use SLBM easily?

Yes, especially if they take online stock trading courses to understand the mechanism better.