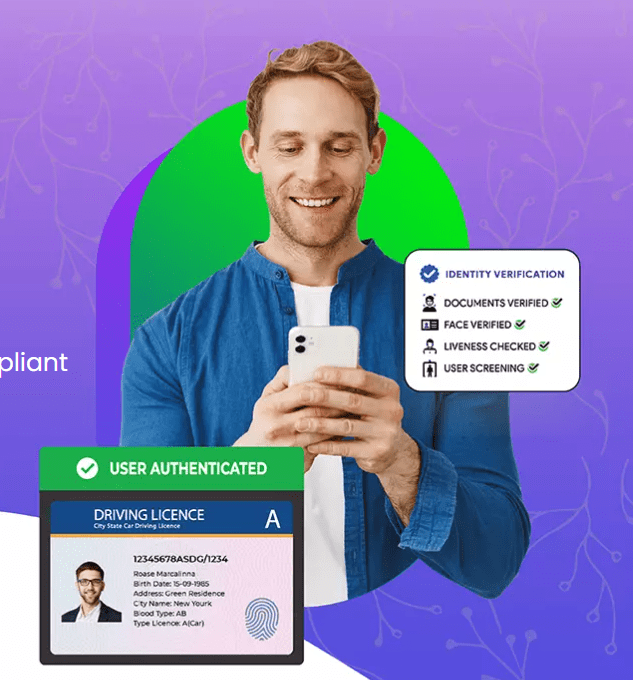

In today’s fast-paced digital landscape, identity fraud and cybercrimes are becoming increasingly sophisticated. Businesses, financial institutions, and service providers need stronger verification methods to ensure their customers are who they claim to be. This is where Face Liveness Checks and Online ID Verification Services play a pivotal role. Together, these technologies provide a seamless, secure, and reliable way to authenticate users while preventing fraudulent attempts.

What is Face Liveness Check?

Face Liveness Check is a security technology designed to confirm that a real, live person is interacting with a verification system, rather than a static image, pre-recorded video, or a 3D mask. Unlike traditional facial recognition, which can sometimes be tricked, face liveness detection ensures that biometric data is captured in real-time.

Key Features of Face Liveness Check:

-

Spoof Detection: Prevents fraudsters from using photos, videos, or masks.

-

Real-Time Interaction: Verifies that the face belongs to a live person during the session.

-

Seamless User Experience: Requires only a smartphone or webcam, making it user-friendly.

-

AI-Driven Accuracy: Uses advanced machine learning algorithms to detect anomalies.

Why is Face Liveness Check Important?

With the rapid increase in digital onboarding, businesses face challenges in protecting customer data and meeting compliance regulations such as KYC (Know Your Customer) and AML (Anti-Money Laundering). Face Liveness Check has become a critical layer of defense.

-

Prevents Identity Theft: Stops bad actors from impersonating genuine users.

-

Enhances Customer Trust: Builds confidence in customers knowing their data is secure.

-

Supports Regulatory Compliance: Helps organizations comply with KYC/AML requirements.

-

Minimizes Fraud Losses: Reduces the financial risks associated with fraudulent activities.

Understanding Online ID Verification Services

An Online ID Verification Service is a digital solution that validates a user’s identity documents and personal information through automated checks. It verifies documents such as passports, driver’s licenses, Aadhaar cards, or national IDs, ensuring they are authentic and match the user’s biometric data.

How Online ID Verification Works:

-

Document Upload: The user scans or uploads an image of their ID.

-

Data Extraction: Optical Character Recognition (OCR) extracts data from the document.

-

Authenticity Check: AI verifies security features, holograms, and watermarks.

-

Biometric Match: The system cross-checks the user’s live selfie with the photo on the document.

-

Instant Results: Provides a pass or fail response in seconds.

Benefits of Online ID Verification Service

Implementing online ID verification solutions ensures businesses can onboard customers quickly and securely.

-

Faster Customer Onboarding: Eliminates manual verification delays.

-

Global Reach: Supports multiple document types across different countries.

-

24/7 Availability: Users can verify their identities anytime, anywhere.

-

Scalability: Ideal for businesses with growing customer bases.

-

Fraud Prevention: Identifies forged or tampered documents.

The Powerful Combination: Face Liveness Check + Online ID Verification

When combined, Face Liveness Check and Online ID Verification create a powerful security ecosystem. Businesses can ensure that not only is the ID document genuine, but also that the person presenting it is real and matches the document photo.

Advantages of the Combination:

-

Dual-Layer Security: Prevents both document forgery and biometric spoofing.

-

Seamless Experience: Customers complete onboarding in minutes without visiting physical offices.

-

Improved Accuracy: Reduces false positives and ensures genuine user authentication.

-

Compliance-Friendly: Meets global regulations like GDPR, KYC, and AML.

Industries Benefiting from These Solutions

Face Liveness Checks and Online ID Verification service are not limited to financial institutions; they are widely adopted across industries.

1. Banking and Finance

-

Prevents fraudulent account openings.

-

Speeds up digital banking services.

-

Ensures compliance with financial regulations.

2. E-commerce

-

Secures transactions against identity fraud.

-

Builds trust between buyers and sellers.

3. Healthcare

-

Protects patient records from unauthorized access.

-

Ensures secure telemedicine consultations.

4. Travel and Hospitality

-

Streamlines digital check-ins at airports and hotels.

-

Reduces manual identity verification hassles.

5. Telecommunications

-

Prevents SIM card fraud.

-

Simplifies new connection activations.

6. Gaming and Online Entertainment

-

Verifies the age and identity of users.

-

Keeps platforms safe from fraudsters and bots.

Best Practices for Implementing Face Liveness and Online ID Verification

Businesses should carefully integrate these technologies to maximize efficiency and user satisfaction.

-

Choose a Trusted Provider: Work with vendors specializing in AI-driven verification.

-

Prioritize User Experience: Keep verification steps simple and intuitive.

-

Ensure Multi-Device Compatibility: Support smartphones, tablets, and desktops.

-

Stay Updated on Regulations: Regularly update systems to comply with KYC/AML standards.

-

Use Continuous Monitoring: Add ongoing verification for high-risk transactions.

Future of Digital Identity Verification

The future of identity verification lies in combining AI, biometrics, and blockchain to create an ecosystem that is fraud-proof and privacy-first. With the rise of deepfakes and advanced spoofing techniques, Face Liveness Check will continue evolving with 3D mapping, behavioral biometrics, and voice recognition. Similarly, Online ID Verification services will become even more sophisticated, ensuring faster and more secure digital interactions.

Final Thoughts

As digital transformation accelerates, businesses cannot afford to rely on outdated methods of identity verification. Face Liveness Check and Online ID Verification Service offer the right balance of security, speed, and convenience. They protect organizations from fraud, improve customer trust, and ensure compliance with global regulations. Companies that adopt these technologies today are better prepared for the challenges of tomorrow’s digital economy.

Author Bio

Shakir Bawani is a digital identity and security enthusiast with expertise in SEO and online fraud prevention solutions. With years of experience in researching and writing about identity verification, biometrics, and compliance technologies, Shakir is passionate about helping businesses embrace secure and user-friendly digital solutions.