Introduction

The needle biopsy market encompasses a comprehensive range of minimally invasive diagnostic procedures and associated medical devices designed to obtain tissue samples for pathological examination and disease diagnosis. This critical healthcare market includes fine needle aspiration procedures, core needle biopsies, vacuum-assisted biopsies, and specialized needle systems used across various medical specialties including oncology, gastroenterology, pulmonology, and interventional radiology. The market serves healthcare providers, pathologists, radiologists, and patients requiring accurate tissue diagnosis with minimal procedural risk and patient discomfort.

Needle biopsy procedures represent the gold standard for tissue diagnosis in numerous clinical scenarios including cancer detection, inflammatory condition assessment, infectious disease diagnosis, and organ transplant monitoring. These procedures offer significant advantages over surgical biopsies including reduced patient morbidity, lower healthcare costs, shorter recovery times, and the ability to perform procedures in outpatient settings under local anesthesia.

The market encompasses various needle types including fine needles for cytological sampling, core biopsy needles for histological specimens, vacuum-assisted devices for enhanced sampling, and specialized needles designed for specific anatomical locations and clinical applications. Advanced imaging guidance systems including ultrasound, computed tomography, magnetic resonance imaging, and mammography enable precise needle placement and improve diagnostic accuracy while minimizing complications.

Healthcare institutions worldwide are implementing needle biopsy programs as primary diagnostic approaches for suspicious lesions, mass evaluation, and tissue characterization. The market has experienced substantial growth driven by increasing cancer incidence, advancing imaging technologies, growing awareness of minimally invasive procedures, and expanding applications across medical specialties.

The Evolution of Needle Biopsy Market

The needle biopsy market has evolved significantly from crude aspiration techniques to sophisticated, image-guided procedures that provide highly accurate diagnostic information with minimal patient risk. Early needle biopsy attempts in the late 19th and early 20th centuries involved blind needle insertion with limited success rates and substantial complication risks due to lack of imaging guidance and inadequate needle design.

Fine needle aspiration emerged as a viable diagnostic technique in the 1950s and 1960s, particularly for thyroid and lymph node evaluation. Swedish physicians pioneered systematic approaches to fine needle aspiration, developing standardized techniques and cytological interpretation methods that established the procedure’s clinical utility and safety profile.

The introduction of imaging guidance revolutionized needle biopsy accuracy and safety in the 1970s and 1980s. Ultrasound-guided procedures enabled real-time visualization of needle advancement, target identification, and complication avoidance, dramatically improving success rates and expanding clinical applications to previously inaccessible anatomical locations.

Computed tomography guidance further enhanced needle biopsy capabilities by enabling precise localization of deep-seated lesions, particularly in the chest, abdomen, and pelvis. CT-guided procedures became standard practice for lung biopsies, liver masses, and retroperitoneal lesions where ultrasound visualization was limited.

Core needle biopsy development provided histological specimens superior to cytological samples alone, enabling more comprehensive pathological evaluation including architectural assessment, immunohistochemical staining, and molecular testing. Automated core biopsy devices improved sample quality and procedural efficiency while reducing operator dependency.

Vacuum-assisted biopsy systems introduced in the 1990s enabled acquisition of larger tissue specimens through single needle insertions, reducing sampling error and improving diagnostic accuracy. These systems became particularly valuable for breast lesion evaluation and suspicious mammographic findings requiring extensive tissue sampling.

MRI-guided biopsy capabilities expanded diagnostic options for lesions visible only on magnetic resonance imaging, particularly in breast cancer detection and prostate evaluation. These advanced procedures require specialized equipment and expertise but provide access to previously unbiopsable lesions.

Market Trends Shaping the Industry

Image-guided precision is becoming increasingly sophisticated with advanced imaging technologies improving needle placement accuracy and diagnostic yield. Real-time imaging feedback, fusion imaging capabilities, and three-dimensional guidance systems enable more precise targeting of small lesions while minimizing complications and sampling errors.

Artificial intelligence integration is transforming needle biopsy procedures through automated lesion detection, optimal pathway planning, and real-time guidance assistance. AI algorithms analyze imaging data to identify suspicious areas, recommend biopsy approaches, and provide decision support for radiologists and clinicians performing procedures.

Molecular diagnostics integration requires high-quality tissue specimens suitable for advanced testing including genomic profiling, biomarker analysis, and personalized medicine applications. Needle biopsy techniques are evolving to provide adequate samples for comprehensive molecular testing while maintaining minimally invasive approaches.

Robotic assistance systems are being developed to enhance needle biopsy precision, reduce operator variability, and enable procedures in challenging anatomical locations. Robotic platforms provide stable needle guidance, automated advancement, and precise positioning that may improve diagnostic accuracy and procedural efficiency.

Point-of-care pathology capabilities including rapid on-site evaluation and immediate adequacy assessment are becoming standard practice in many institutions. These approaches reduce repeat procedures, improve diagnostic efficiency, and provide immediate feedback on sample quality during biopsy procedures.

Outpatient procedure expansion continues as healthcare systems seek to reduce costs while maintaining quality care. Needle biopsy procedures are increasingly performed in outpatient settings, ambulatory surgery centers, and office-based facilities rather than traditional hospital environments.

Specialized needle designs for specific applications are proliferating, including coaxial systems for multiple sampling, cutting needles for hard lesions, and flexible needles for difficult anatomical approaches. These specialized devices address unique clinical challenges and improve diagnostic success rates.

Patient safety enhancements include improved needle visibility under imaging, safety mechanisms to prevent accidental injury, and ergonomic designs that reduce procedure time and operator fatigue. Safety considerations are driving innovation in needle design and procedural protocols.

Challenges Facing the Needle Biopsy Market

Sampling adequacy concerns affect diagnostic accuracy and may require repeat procedures, increasing patient burden and healthcare costs. Factors influencing sample quality include lesion characteristics, needle selection, operator experience, and pathological processing techniques that must be optimized for reliable diagnosis.

Complication risks, while generally low, include bleeding, pneumothorax, infection, and organ injury that can result in serious patient morbidity. Risk mitigation strategies, patient selection criteria, and operator training are essential for maintaining safety standards while expanding procedure volumes.

Operator skill dependency affects procedure success rates and diagnostic accuracy, creating variability in outcomes between different healthcare providers and institutions. Standardized training programs, certification requirements, and quality assurance measures are needed to ensure consistent results.

Cost pressures from healthcare systems seeking to reduce diagnostic expenses while maintaining quality create challenges for premium needle biopsy devices and advanced imaging guidance systems. Value-based healthcare models require demonstration of improved outcomes and cost-effectiveness.

Regulatory requirements for needle biopsy devices continue to evolve with increasing emphasis on clinical evidence, safety data, and quality management systems. Manufacturers must navigate complex approval processes while developing innovative products that meet regulatory standards.

Alternative diagnostic methods including liquid biopsies, advanced imaging techniques, and non-invasive testing approaches may reduce demand for tissue-based diagnosis in certain clinical scenarios. The market must adapt to evolving diagnostic paradigms and demonstrate continued value.

Reimbursement challenges affect procedure adoption and access, particularly for newer techniques and premium devices that may not have established coverage policies. Healthcare providers require adequate reimbursement to justify investments in advanced needle biopsy technologies.

Training and education requirements for healthcare providers performing needle biopsies create barriers to market expansion. Comprehensive training programs, continuing education requirements, and competency assessment are necessary but resource-intensive.

Market Scope and Applications

Oncology applications represent the largest market segment, with needle biopsies essential for cancer diagnosis, staging, and treatment planning across multiple organ systems. Breast, lung, liver, prostate, and lymph node biopsies constitute the highest volume procedures, requiring specialized needles and imaging guidance appropriate for each anatomical location.

Breast biopsy procedures utilize various needle biopsy techniques including stereotactic, ultrasound-guided, and MRI-guided approaches for evaluating suspicious mammographic findings and palpable masses. Vacuum-assisted devices and clip placement systems are commonly employed for precise sampling and lesion marking.

Pulmonary applications include transthoracic needle biopsies for peripheral lung lesions, mediastinal masses, and pleural abnormalities. CT guidance is typically employed for these procedures, with careful attention to pneumothorax prevention and patient selection criteria.

Hepatic biopsy procedures evaluate liver masses, diffuse liver disease, and transplant rejection using ultrasound or CT guidance. Coaxial needle systems enable multiple samples while minimizing bleeding risk and patient discomfort during these procedures.

Prostate biopsy applications include transrectal ultrasound-guided systematic sampling and MRI-fusion targeted biopsies for suspicious lesions. These procedures require specialized transrectal probes and precision targeting systems for optimal diagnostic yield.

Thyroid and neck applications utilize fine needle aspiration for nodule evaluation, with ultrasound guidance enabling precise sampling of small lesions and complex anatomical locations. Molecular testing capabilities are increasingly important for indeterminate cytological results.

Musculoskeletal applications include bone and soft tissue mass evaluation using CT or ultrasound guidance. These procedures often require specialized needles capable of penetrating dense tissues while providing adequate samples for pathological diagnosis.

Gastrointestinal applications encompass endoscopic ultrasound-guided fine needle aspiration for pancreatic masses, lymph nodes, and other lesions accessible through the gastrointestinal tract. These procedures require specialized endoscopic equipment and needle systems.

Market Size and Growth Projections

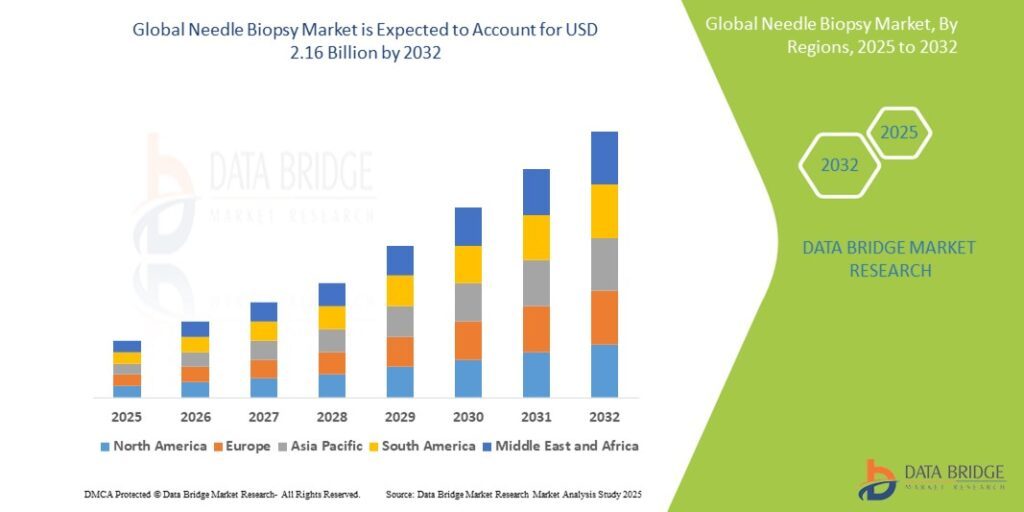

The global needle biopsy market has demonstrated consistent growth over recent years, with current market valuation reflecting increasing procedure volumes, technological advancement, and expanding clinical applications. Industry analysts project continued growth at compound annual growth rates in the high single digits, driven by aging populations, rising cancer incidence, and advancing diagnostic technologies.

Regional market analysis reveals North America as the largest market, supported by advanced healthcare infrastructure, high diagnostic imaging utilization, and established reimbursement systems for needle biopsy procedures. The region benefits from early adoption of innovative technologies and comprehensive cancer screening programs.

Europe represents another significant market characterized by well-developed healthcare systems and increasing emphasis on minimally invasive diagnostic procedures. European markets demonstrate growing adoption of advanced imaging guidance and specialized needle biopsy devices across various medical specialties.

Asia-Pacific markets are experiencing rapid growth driven by improving healthcare infrastructure, increasing cancer awareness, and expanding access to advanced diagnostic technologies. Countries such as Japan, China, and South Korea are investing substantially in medical imaging capabilities and interventional procedures.

Latin America and Middle East & Africa represent emerging markets with substantial growth potential as healthcare systems develop and diagnostic capabilities expand. These regions benefit from increasing healthcare investment and growing awareness of early cancer detection benefits.

Market segmentation by product type shows that core needle biopsy devices represent the largest segment, while vacuum-assisted systems and specialty needles demonstrate higher growth rates. Imaging guidance systems and accessories contribute significantly to overall market value.

End-user analysis indicates that hospitals represent the largest market segment, while outpatient imaging centers and ambulatory surgery centers are experiencing rapid growth as procedures migrate to lower-cost settings. Academic medical centers lead in adoption of advanced technologies and novel procedures.

The competitive landscape includes established medical device manufacturers, specialized biopsy companies, and emerging technology developers creating innovative solutions. Market consolidation continues as larger companies acquire specialized technologies and expand product portfolios.

Factors Driving Growth in the Needle Biopsy Market

Rising cancer incidence worldwide represents the primary market driver as early detection and accurate diagnosis become increasingly important for optimal patient outcomes. Aging populations and lifestyle factors contribute to growing cancer rates that require comprehensive diagnostic approaches including tissue sampling.

Technological advancement in imaging guidance systems enables more precise needle placement, improved diagnostic accuracy, and expanded procedural capabilities. Advanced ultrasound systems, CT guidance improvements, and MRI compatibility enhance procedure success rates while reducing complications.

Minimally invasive procedure preferences among patients and healthcare providers drive adoption of needle biopsy techniques over surgical alternatives. Cost-effectiveness, reduced morbidity, and shorter recovery times make needle biopsies attractive options for tissue diagnosis.

Healthcare cost containment initiatives favor outpatient procedures and minimally invasive approaches that reduce healthcare expenditure while maintaining diagnostic quality. Needle biopsies align with value-based healthcare models emphasizing efficiency and patient outcomes.

Screening program expansion for various cancers increases detection of suspicious lesions requiring tissue confirmation. Mammography screening, lung cancer screening, and other early detection programs generate substantial demand for needle biopsy procedures.

Personalized medicine requirements necessitate high-quality tissue specimens for molecular testing, biomarker analysis, and genomic profiling. Needle biopsy techniques must evolve to provide adequate samples for comprehensive molecular diagnostics.

Interventional radiology growth as a medical specialty expands the pool of physicians capable of performing advanced needle biopsy procedures. Training programs and subspecialty development support market expansion and procedure standardization.

Quality improvement initiatives in pathology and radiology emphasize accurate diagnosis and efficient procedures that meet quality metrics and safety standards. These initiatives drive adoption of advanced needle biopsy technologies and standardized protocols.

Emerging market healthcare development creates opportunities for needle biopsy market expansion as countries invest in diagnostic capabilities and cancer care infrastructure. These markets represent substantial growth potential for medical device manufacturers.

Regulatory support for innovative medical devices includes expedited approval pathways and breakthrough device designations that accelerate market entry for promising technologies. Regulatory agencies recognize the importance of advanced diagnostic capabilities.

Professional society guidelines and recommendations promote appropriate use of needle biopsy procedures and establish standards for training, quality assurance, and patient care. These guidelines support market growth and technology adoption.

Research and development investment in needle biopsy technologies attracts venture capital funding and pharmaceutical industry support for companies developing innovative solutions. Scientific advancement drives continued market innovation and expansion.

The needle biopsy market continues to evolve with advancing technologies, expanding applications, and growing recognition of minimally invasive diagnostic approaches. While challenges exist in training, standardization, and cost management, the fundamental importance of accurate tissue diagnosis ensures continued market growth and innovation opportunities across diverse medical specialties and healthcare settings.

Other Trending Reports

https://www.databridgemarketresearch.com/reports/global-technical-fluids-market

https://www.databridgemarketresearch.com/reports/global-neurosurgery-market

https://www.databridgemarketresearch.com/reports/global-laboratory-glassware-market

https://www.databridgemarketresearch.com/reports/global-dried-figs-market

https://www.databridgemarketresearch.com/reports/global-appetite-stimulant-market

https://www.databridgemarketresearch.com/reports/europe-fall-protection-market

https://www.databridgemarketresearch.com/reports/global-dioctyl-phthalate-market

https://www.databridgemarketresearch.com/reports/global-digital-video-advertising-market