Vodafone Idea Share Price History: A Complete Analysis

Introduction

Vodafone Idea (Vi) has been a prominent player in India’s telecom industry, but its share price journey has been nothing short of a rollercoaster. Whether you are an investor, trader, or simply curious about its stock performance, understanding its historical price movements can offer key insights.

How has Vodafone Idea’s stock performed over the years? What factors have influenced its rise and fall? And how can the best algo trading software in India help investors make informed decisions?

Explore Vodafone Idea share price history & trends. Learn how the best algo trading software in India helps analyze stocks. Best algorithmic trading software India.

Vodafone Idea: A Brief Overview

Vodafone Idea Ltd. was formed in 2018 through the merger of Vodafone India and Idea Cellular. The company aimed to create a stronger telecom presence in India but faced financial and regulatory hurdles.

IPO and Early Share Performance

Before the merger, both Vodafone and Idea Cellular had their own stock performance trends. Idea Cellular had a decent market presence, while Vodafone was a global giant in telecom.

Impact of Vodafone and Idea Merger on Share Price

The merger was seen as a strategic move, but it led to an initial dip in share prices due to debt concerns and integration challenges.

Key Milestones in Vodafone Idea Share Price History

- 2018: Share prices dropped post-merger.

- 2019: AGR (Adjusted Gross Revenue) dues created financial distress.

- 2020: Government relief measures helped stabilize prices.

- 2021-2023: 5G rollout and investor interest brought fluctuations.

Regulatory Challenges and Their Effect on the Stock

Vodafone Idea has faced major regulatory issues, including AGR dues, spectrum fees, and government interventions, all of which impacted investor confidence.

Financial Performance and Quarterly Trends

Examining the company’s quarterly results reveals significant losses, debt burden, and revenue struggles, leading to volatility in stock prices.

Government and Policy Impacts on Share Price

Government decisions, including telecom relief packages, have played a major role in influencing the share price of Vodafone Idea.

Competitor Influence on Vodafone Idea Shares

Reliance Jio and Bharti Airtel’s aggressive pricing and expansion strategies have added pressure on Vodafone Idea, affecting its market share and stock value.

Investor Sentiment and Market Speculations

Stock prices often fluctuate based on investor sentiment, news coverage, and speculation about Vodafone Idea’s financial stability and future prospects.

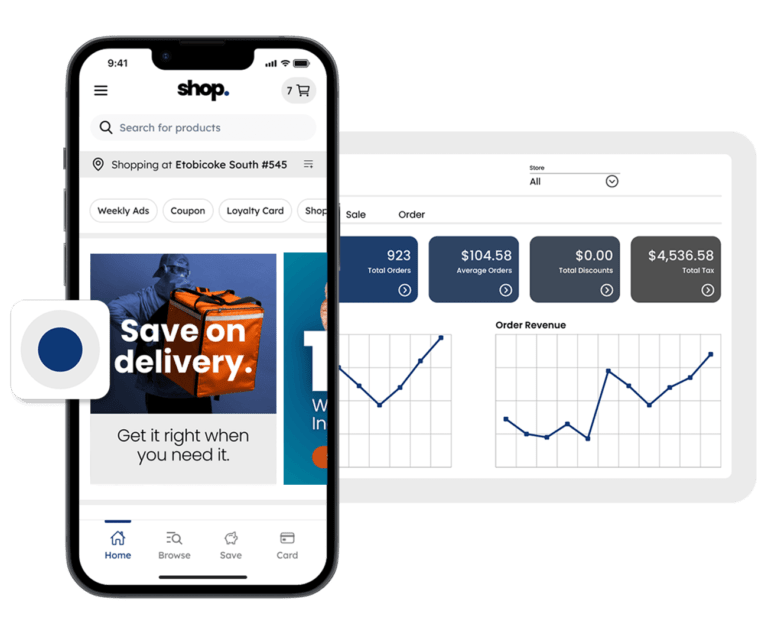

How Algo Trading Helps Analyze Vodafone Idea’s Stock

Algorithmic trading helps traders analyze Vodafone Idea’s stock movements through:

- Pattern recognition: Detecting price trends.

- Automated execution: Faster trades based on preset conditions.

- Risk management: Reducing human errors in trading decisions.

Best Algorithmic Trading Software India for Stock Analysis

Some of the best algo trading software in India for analyzing Vodafone Idea’s stock include:

- Zerodha Streak – User-friendly and efficient.

- TradeTron – AI-based automated strategies.

- AlgoBulls – Offers pre-built trading models.

Future Predictions for Vodafone Idea’s Stock Price

Experts suggest that Vodafone Idea’s future depends on:

- Debt restructuring and funding

- Customer retention strategies

- Government support and relief packages

Should You Invest in Vodafone Idea Shares?

Investing in Vodafone Idea requires a careful risk assessment. While it has potential for recovery, it also faces significant challenges.

Conclusion

Vodafone Idea’s share price history reflects its struggles and opportunities. While it remains a volatile stock, algorithmic trading can help investors make better trading decisions. If you’re considering investing, ensure you analyze the market trends using the best algorithmic trading software India has to offer.

FAQs

Why did Vodafone Idea’s share price fall?

Vodafone Idea’s stock declined due to high debt, AGR dues, and tough competition from Reliance Jio and Airtel.

Can Vodafone Idea stock recover?

Recovery depends on government support, financial restructuring, and business performance.

What is the best algo trading software in India for Vodafone Idea shares?

Top options include Zerodha Streak, TradeTron, and AlgoBulls for automated trading strategies.

How does algorithmic trading help in analyzing Vodafone Idea shares?

It enables automated trading decisions, pattern recognition, and risk management for better trade execution.

Should I invest in Vodafone Idea shares now?

Consider factors like financial health, market trends, and expert opinions before making an investment decision.